Increasing Broadband Internet Penetration

In the OIC Member Countries

49

The fixed broadband demand gap estimates in table 14 require some interpretation. First, the

countries where the fixed broadband demand gap is lower than 10% indicates a

supply/demand equilibrium, where fixed broadband service coverage is matched by

household penetration. Not surprisingly, most of these countries are the developed ones

(Australia, Belgium, Canada, Denmark, France, Greece, Iceland, Ireland, Israel, Luxembourg,

Malta, Netherlands, New Zealand, Norway, Slovenia, Switzerland, United Kingdom)

25

. Second,

there are some advanced countries where the fixed broadband demand gap ranges between

10% and 20% (Estonia, Germany, Japan, Portugal, Spain, United States). In this case, the gap

can be explained primarily by fixed-mobile substitution. The early and aggressive deployment

of 4G mobile broadband technology has resulted in wireless capturing a portion of the fixed

demand. This also the case for some of advanced countries where the fixed broadband demand

gap exceeds 20% (Austria, Czech Republic, Finland, Italy, Sweden). Finally, there are some

emerging countries with a consistent imbalance between supply and demand, where the

demand gap reaches 30% and higher (Argentina, Bolivia, Chile, Colombia, Costa Rica, Ecuador,

Mexico, Romania). Reasons for this gap are multi-fold, ranging from limited affordability to

lack of local content. This point will be reiterated at the end of this section, after analyzing the

mobile broadband demand gap.

The mobile broadband demand gap is calculated by subtracting the percent of population that

are broadband subscribers from the percent of the population covered by 3G networks. In this

case, the estimates are calculated by region of the world because data is available for most

countries (see table 15).

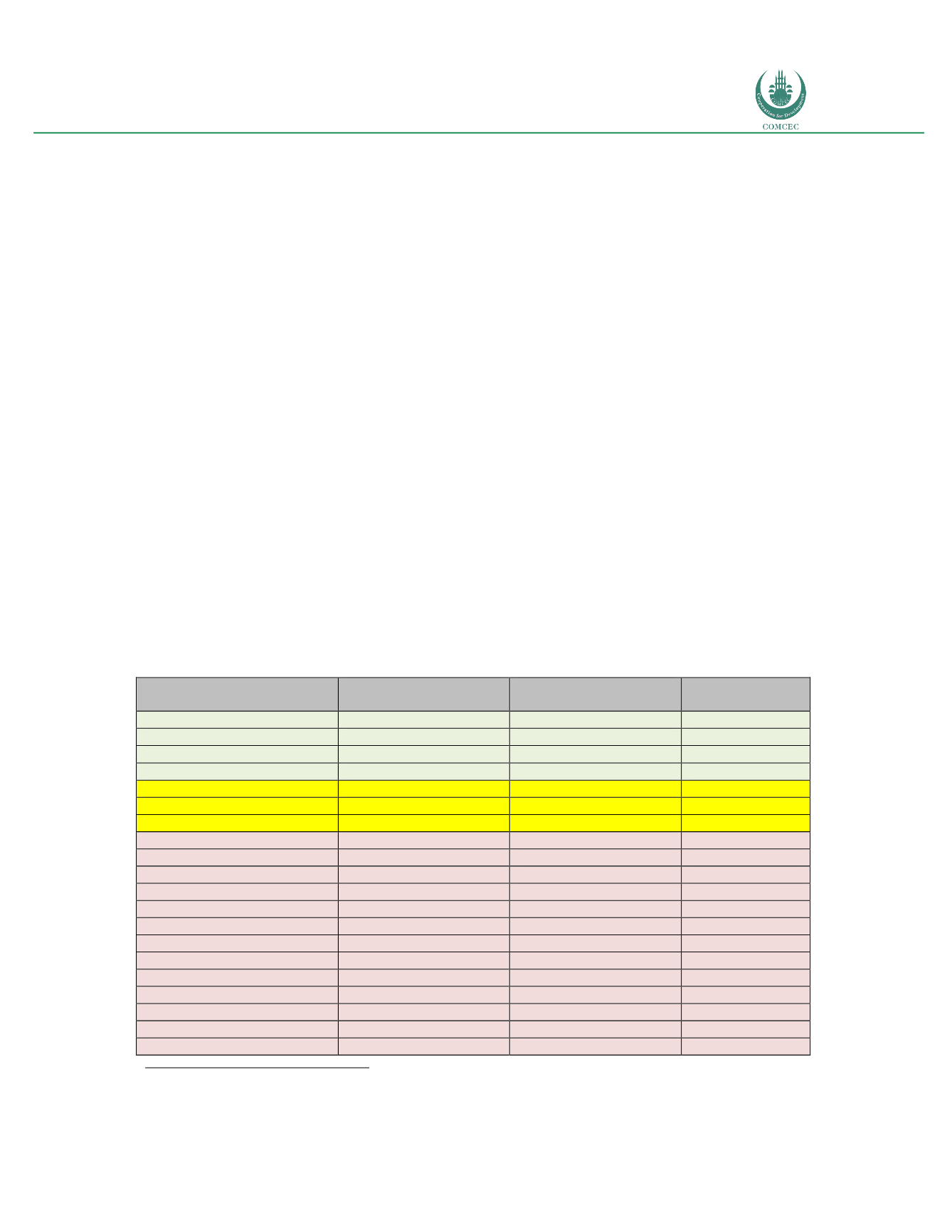

Table 15: Mobile broadband demand gap (2015)

Country

Population Covered

(3G) (

%

)

Connections

Penetration (

%

)

Demand Gap (

%

)

Australasia

98.80

113.04 (*)

0

Northern America

99.80

103.93 (*)

0

Eastern Asia

61.95

62.96 (*)

0

Northern Europe

99.06

95.69

3.37

OECD Countries

97.78

87.17

10.61

Micronesia

15.34

0.27

15.07

Eastern Europe

76.92

58.54

18.38

Central Asia

54.86

33.20

21.66

Western Europe

97.64

74.75

22.89

Middle Africa

32.06

8.92

23.14

Southern America

91.28

67.37

23.91

Southern Europe

97.67

72.80

24.87

South-Eastern Asia

72.64

46.87

25.77

Northern Africa

72.56

43.13

29.43

Polynesia

48.56

18.41

30.15

Caribbean

54.02

19.78

34.24

Melanesia

46.57

11.15

35.42

Southern Africa

94.75

58.19

36.56

Western Asia

85.55

46.39

39.16

Western Africa

64.68

23.22

41.46

25

Uruguay is a particular emerging market case. A strong public program has recently completed an FTTH deployment, as a

result of which fixed broadband is being offered on a subsidized basis (e.g. low speed service is being connected for free).