Improving Transport Project Appraisals

In the Islamic Countries

5

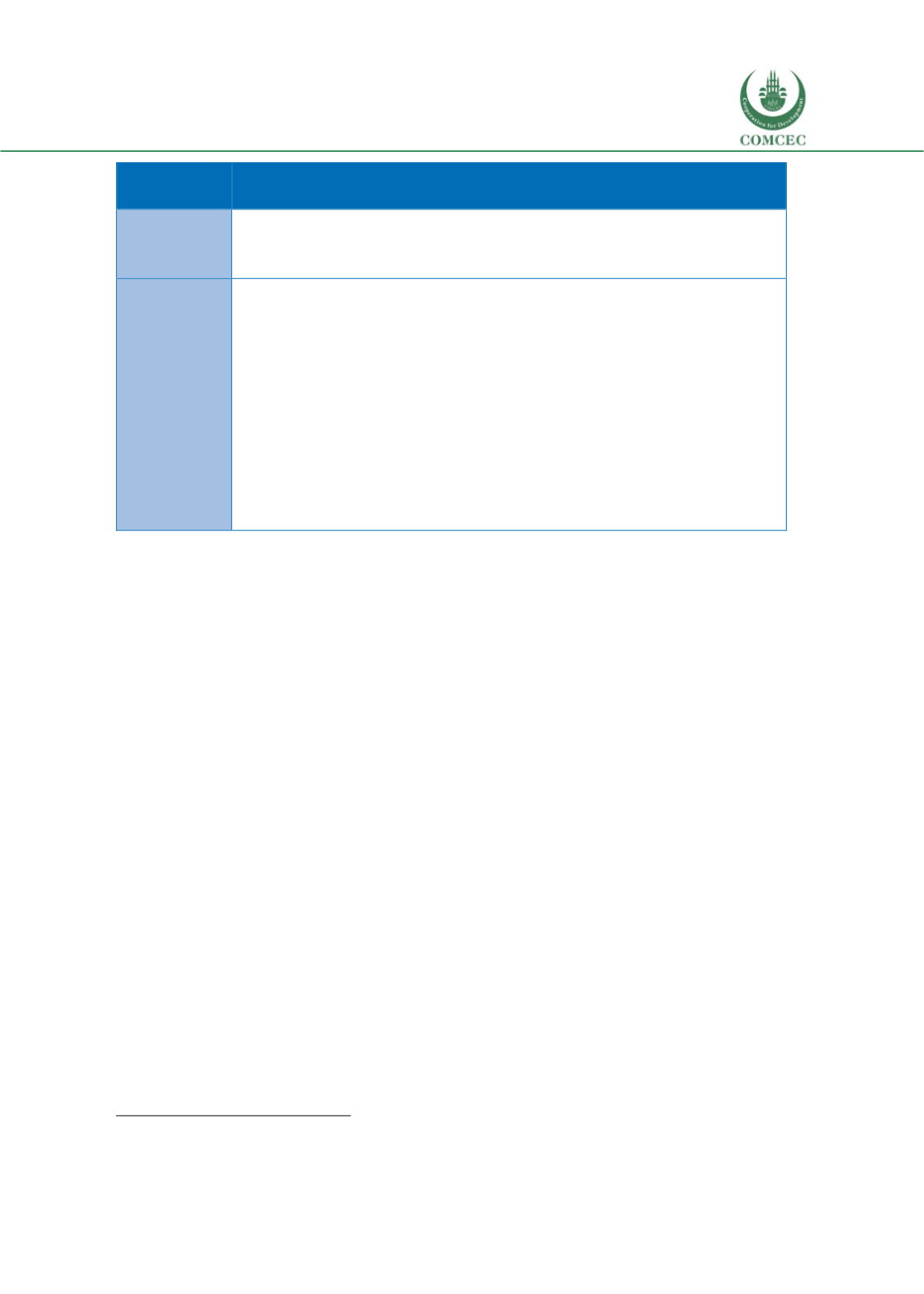

Appraisal

aspect

Description

Selection criteria

: Is it possible to select project with a negative economic

result? How is alignment with strategies ensured? How are qualitative and

quantitative evidence combined in the final assessment?

Follow-up

and learning

Monitoring:

Is basic completion review performed? Do rules exist

regarding obligations and requirements of completion reviews to identify

forecasting errors or managerial problems? Is project appraisal constantly

updated as monitoring and management tool to improve project

resilience?

Ex-post evaluation:

Is ex-post evaluation of project carried out? If yes,

when it is usually carried out? Do rules exist on how many years after the

project completion the ex-post evaluation should be carried out or is this

left to occasional initiatives? Is ex-post evaluation carried out periodically

on a sample of investments or rather on a selective basis? If ex-post project

appraisal is performed, how are they used as a learning mechanism?

Source: CSIL

Transport project appraisal in OIC countries

Legal basis

In most OIC member countries, no legislation is in place that stipulates transport project

appraisal to be carried out. A notable exception is Iran, where a legal requirement to carry out

project appraisal stems from the rules set by the Plan and Budget Organisation (PBO) and is

applied to all public investments, not only in the transport sector. The need to carry out project

appraisal is also prescribed in Jordan, by the Ministry of Planning and International

Cooperation

2

.

Although in many cases there may not be a specific law, which requires project appraisal to be

carried out, often some kind of legislation is in place that (indirectly) calls for project appraisal

to be implemented as a pre-condition for funding. This can be in the form of a

procurement law

,

which stipulates a number of steps to be carried out before a project can be tendered, including

feasibility studies as one of the mandatory steps, as seen in Nigeria. Furthermore, a

PPP law

may

be in place, requiring, feasibility study and CBA to be carried out, as a mandatory step before a

project can be considered for PPP, as in the case of Jordan and Iran

3

. It should be noted that the

scope of PPP related appraisal often focuses on

bankability and financial evaluation

of projects

and places less emphasis on socio-economic evaluation. This is also the case of all projects that

fundedwith the

support of development partners or IFIs

, as this is firmly embedded in procedures

of these organisation and as such a pre-condition for providing funding.

2

Which is considering a Public Investment Management unit to further support this process.

3

Although in Iran CBA is not specifically required.