Single Window Systems

In the OIC Member States

46

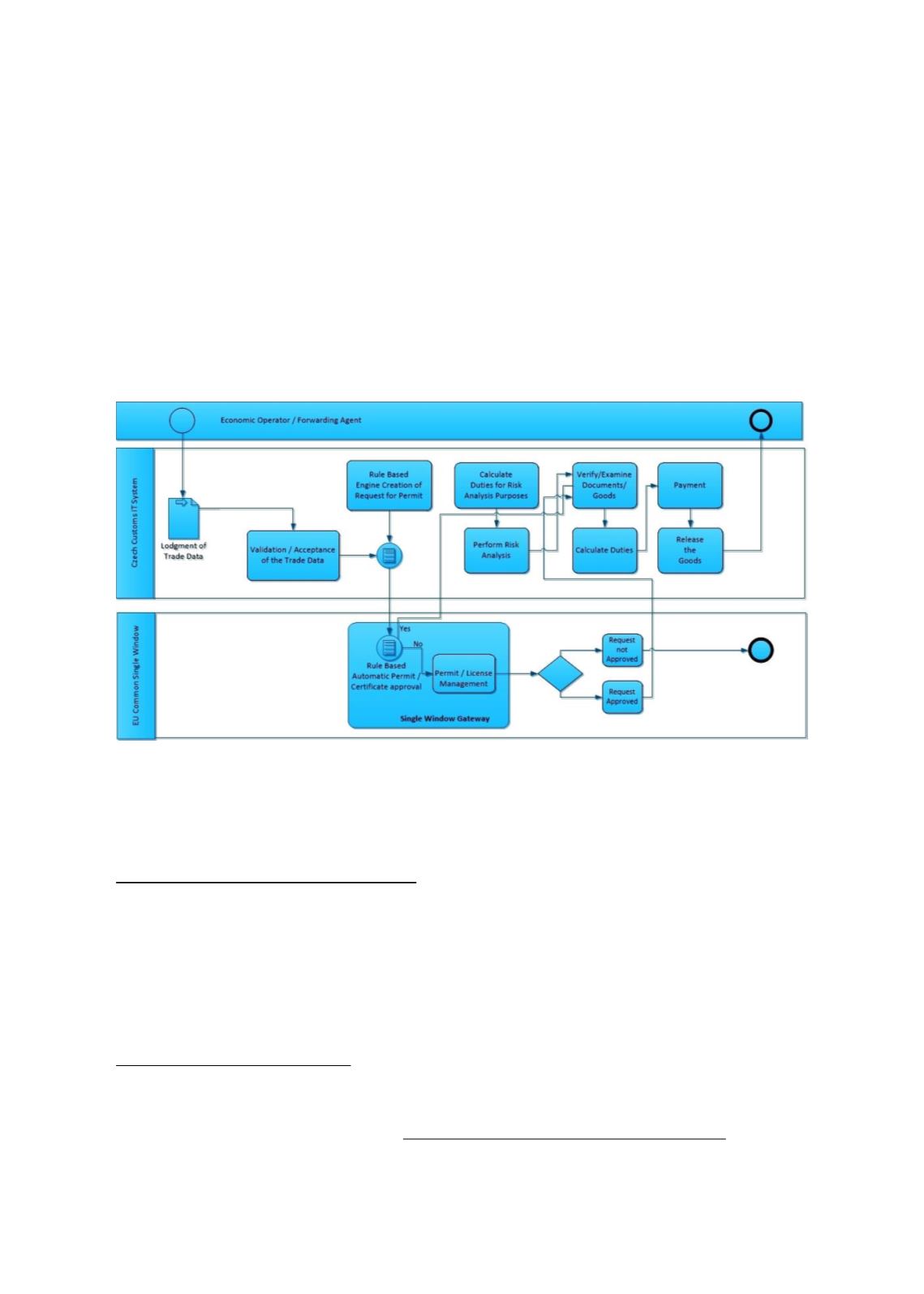

creating request for permit and certificate according HS Code. The request for permit and

certificate is then sent via EU Common Communication Network / Common System Interface

(CCN/CSI) to the EU Common Single Window - competent Directorate General (ex. DG AGRI, DG

Health and Food Safety etc.). The DG rule / risk profile based system is automatically approving

the request for permit and certificate. Manual intervention is possible but only required for a

limited percentage of all transactions. The process from creation of the request for permit and

certificate to approval is few seconds. The approved permits and certificates are sent back to the

MS Customs Declaration Processing System and linked with the SAD for further processing.

Figure 16: Issuing of Permits and Certificates and Customs Clearance on EU Level

Source: Authors’ own construction

The digital signature for every transaction between traders and the Single Window and CDPS is

mandatory

45

. The digital signatures are issued by Accredited Certified Authorities based on the

Authorization for e-communication for all customs procedures

46

.

Czech Single Window ICT Architecture

The CZSW is integrated within a centralized IT Architecture with customs declaration

processing system (CDPS). The Enterprise IT Architecture of the Czech Customs is based on a

Service-Oriented Architecture (SOA), managing the CDPS and further DG TAXUD IT Systems

47

.

The interconnectivity and interoperability with the DG TAXUD IT Systems and EU certificates

45

Art. 199(4b) of EU Reg. 2454/93 and Law 227/2000 Coll. on e-signature

46

Rules & conditions are in Art 199(4a) of EU Reg. 2454/93 (used for identification and verification of the traders).

47

These IT systems include, inter alia, the databases for Authorised Economic Operators and for Electronic Binding Tariff

Information. For a an overview and description se

e http://ec.europa.eu/taxation_customs/online-services_en (Accessed

January 2017).