Improving Public Debt Management

In the OIC Member Countries

174

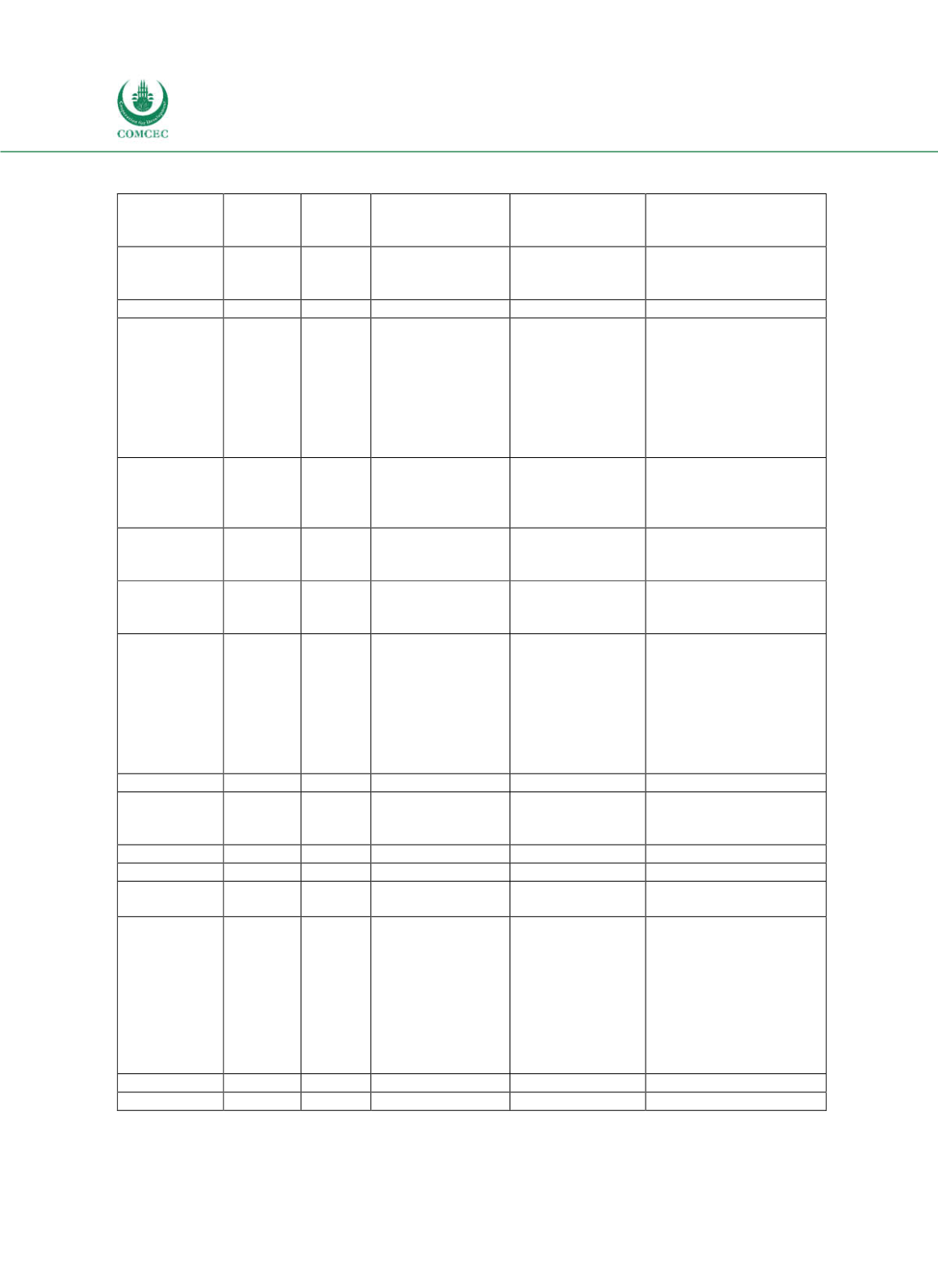

Table 4-13: Comparison of Debt Management Objectives in Case Study Countries

Country

Formal

DeM

strategy

Targets Currency risk

Interest rate risk

Refinancing risk

Gambia

yes

no

Increase ext.

borrowing

(concessional)

Mozambique

yes

no

Togo

yes

no

Extend concessional

and semiconcessional

ext.

borrowing which

generally has higher

maturities;

Target maturities of 310 years for dom.

borrow.

Uganda

yes

yes

Dom. to ext. debt:

40:60;

FX share: Max.

80%

ATR: Min. 10

years

ATM: Min. 3 years;

Debt maturing in 1 year:

15%

Egypt

yes

yes

Dom. to ext. debt:

85:15

Share of fixed

rate debt: 100% ATM: 2.5 years

Debt maturing in 1 year:

Max. 50%

Indonesia

yes

yes

FX share: 39% Share of fixed

rate debt: 89% ATM: 9 years;

Debt maturing in 3

years: 22%

Nigeria

yes

yes

Dom. to ext. debt:

60:40;

Dom. debt mix of

75:25 for long and

shortterm debts.

Increase ext.

borrowing

(concessional)

ATR: Min. 10

years

ATM: Min. 10 years;

Debt maturing in 1 year:

Max. 20%

Sudan

no

no

Albania

yes

FX proportion:

5055%

ATR: Min.

3

years

ATM: Min. 4.7 years;

Debt maturing in 1 year:

Max. 26%

Iran

no

no

Kazakhstan

yes

no

Lebanon

yes

yes

Increased ext.

borrowing

ATR: Min. 4.3

years

ATM: Min. 4.3 years

Turkey

yes

yes*

Make borrowing

mainly in TL

Fixed rate TL

instruments as

major source of

dom.

cash

borrowing;

Decrease share

of

debt with

interest

rate

refixing < 1 year

Increase average

maturity of dom. cash

borrowing;

Decrease share of debt

maturing within 12

months.

Oman

no

no

Saudi Arabia

no

no

Note: * not published; ATM = Average Time to Maturity; ATR = Average Time to Refixing.

Sources: Public debt management strategies, ifo Debt Management Survey (2016).