National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

40

Chart

2.26: Geographical Distribution of Global Sukuk Issues

Source: Calculated from IIFM Sukuk Report 2016

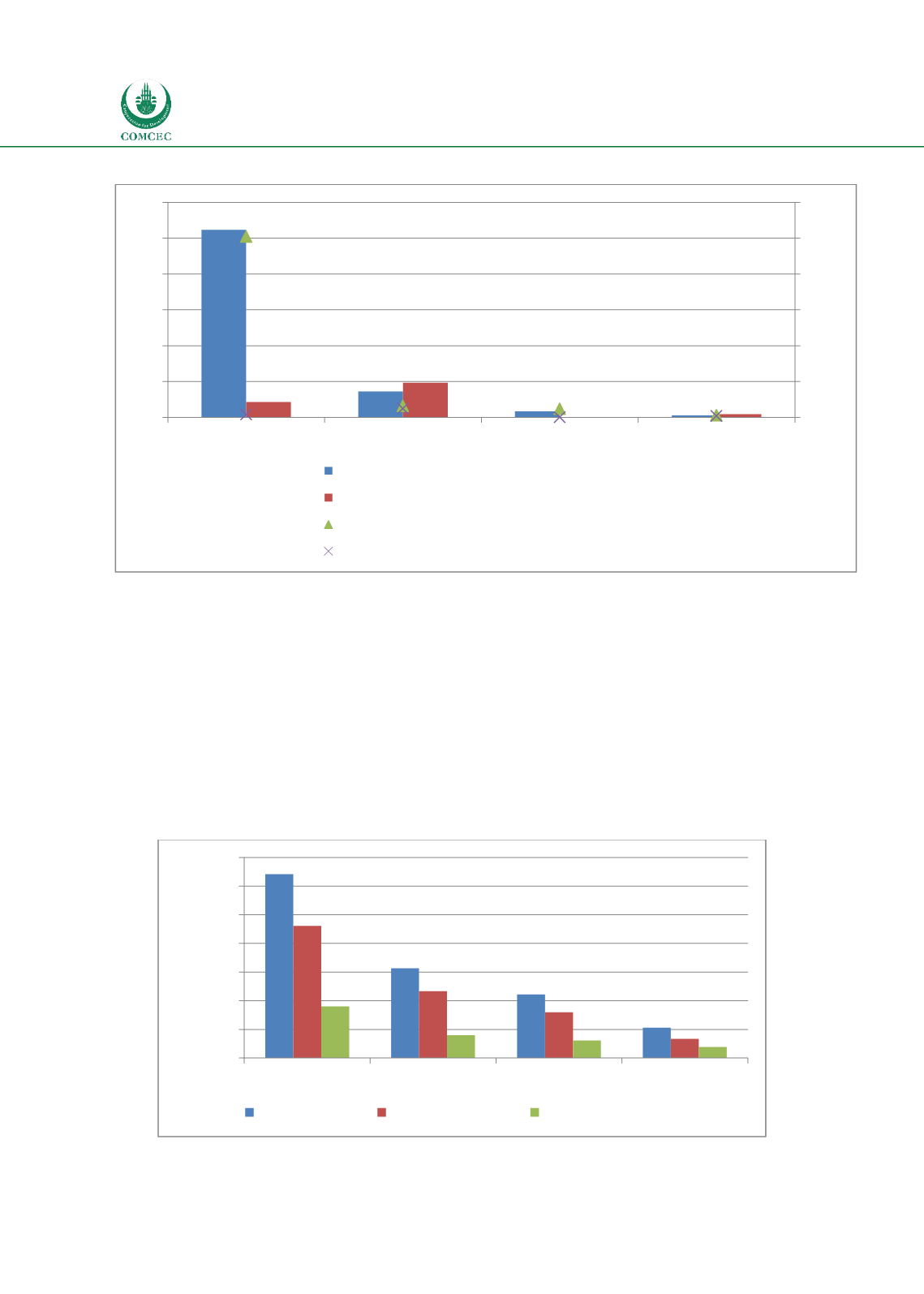

Charts 2.27 and 2.28 show sukuk issuances by different types of issuers, with the former

showing the total sukuk outstanding as of 31 December 2015 and the latter showing the

issuances in 2015. Chart 2.27's depiction of the total sukuk outstanding as of December 2015

was USD 321 billion of which USD 230.6 billion were domestic and USD 90.4 billion were

international. The distribution of the outstanding balances of the total was highest for the

corporates (USD 156.9 billion) followed by sovereign (USD 111 billion) and quasi-sovereign

(USD 53.1 billion). The corresponding figures for domestic and international outstanding

sukuk are given in Chart 2.27. Note that while global sukuk indicates the value of all sukuk

issued globally, international sukuk are those that are sold beyond national borders to both

national and international investors, as opposed to domestic markets only.

Chart

2.27: Total Sukuk Outstanding as of 31 Dec 2015 (USD, bn.)

Source: Calculated from IIFM Sukuk Report 2016

523,6

72,2

16,9

5,6

43,0

96,7

0,6

8,5

5038

320

240

57

78

243

2

36

0

1000

2000

3000

4000

5000

6000

0

100

200

300

400

500

600

Asia & Far East

GCC & Middle East

Africa

Europe & Others

Total Domestic Sukuk Issuances (US$, bn.)

Total International Sukuk Issuances (US$, bn.)

Total Domestic Sukuk Issuances (No. of Issues)

Total International Sukuk Issuances (No. of Issues)

321,0

156,9

111,0

53,1

230,6

116,8

80,1

33,7

90,4

40,1

30,9

19,4

0

50

100

150

200

250

300

350

Total

Corporate

Sovereign Quasi-Sovereign

USD (bn.)

Global Sukuk Domestic Sukuk International Sukuk