Islamic Fund Management

71

Country

Stage of

Development

Rationale

USD6,160.7 in 2017. The country’s classification as

‘developing (intermediate)’ depicts its budding potential,

but requires concerted efforts by key stakeholders to

identify a sustainable value proposition.

Morocco

Infancy

The Islamic finance industry in Morocco is still in its nascent

stage. Islamic banking only commenced in 2017, following

several financial reforms. To date, Morocco has yet to create

a Shariah screening methodology since its Islamic fund

management industry is officially non-existent, although

two ethical funds have Shariah-compliant structures.

Furthermore, the development of its capital markets still has

much room to grow, with the banking sector dominating the

financial market. Given this, Morocco falls under the

‘infancy’ category. As at end-2017, its GDP per capita was

USD3,007.2.

Sources: RAM, ISRA

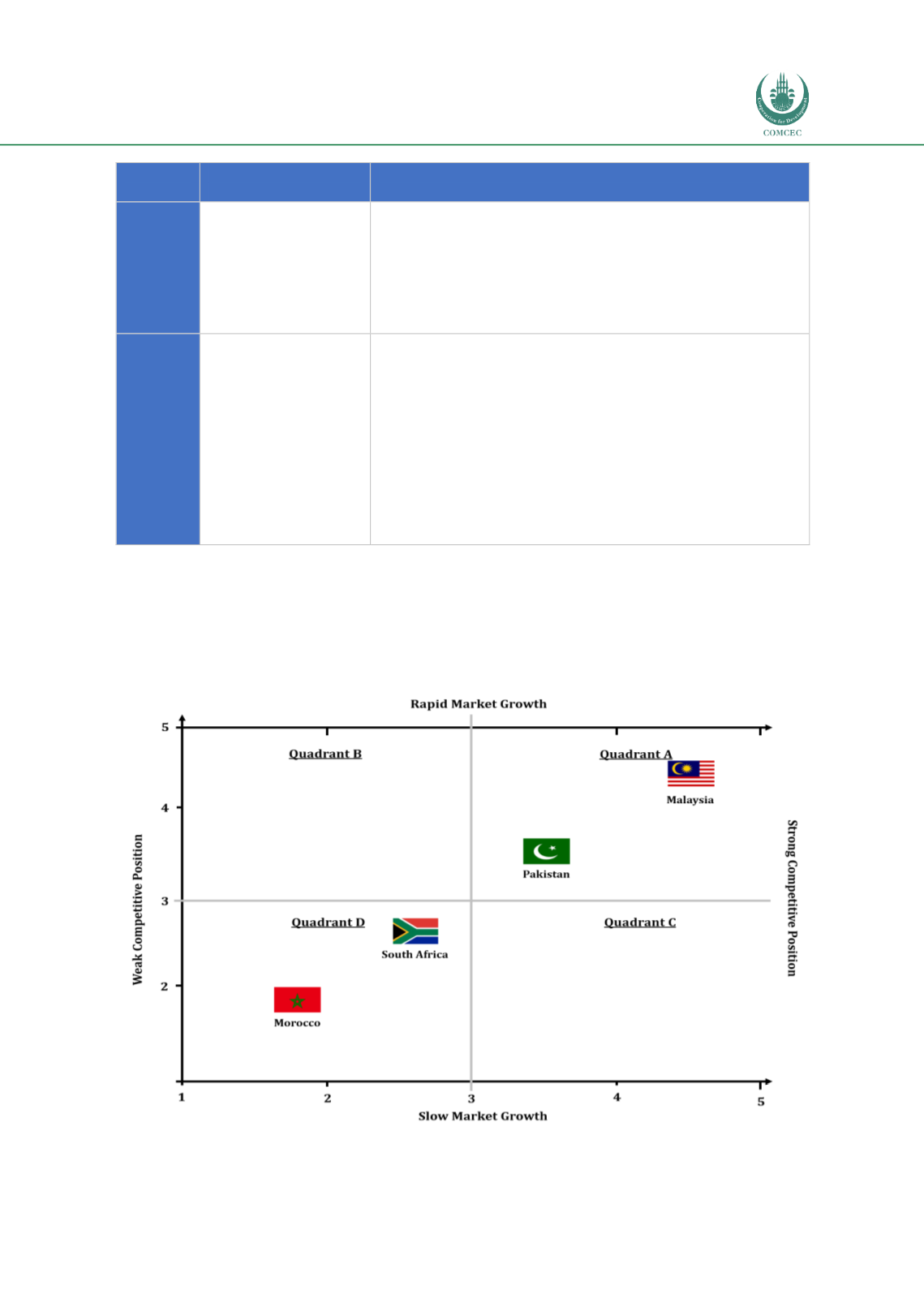

Based on the development-stage matrix,

Chart 4.1further illustrates the position of each

country in the four quadrants, which provided an overview of their level of progress relative to

market growth and competitive position.

Chart 4.1: Positioning of Each Country in the Four Quadrants

Sources: RAM, ISRA