Islamic Fund Management

155

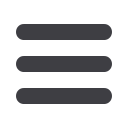

Figure 5.1: Ecosystem of the Islamic Fund Management Industry

Equities

Fixed Income

MoneyMarket

REITs

ETFs

Balanced Funds

Sustainability

of Shariah

Assets

Five Core Pillars

Legal, Regulatory,

Shariah

Framework&

Market

Supervision

Development of

Institutional

Funds

Tax Framework

Market

Infrastructure

Liberalisation

of Policies

and Guidelines

Demand for

Shariah Assets

Source: RAM

As mentioned earlier, the establishment of the necessary pillars to kick-start or support the

development of the Islamic fund management industry is key to ensuring sustainable organic

growth. However, a definitive structure must be established upfront to ensure the pillars are

successfully incorporated. The framework should also highlight the roles and responsibilities

of key stakeholders and identify actionable measures to promote accountability and

monitoring of progress, in line with the proposed roadmap. The factors listed in

Table 5.1should be taken into consideration in the development of the framework and roadmap for the

Islamic fund management industry.

Table 5.1: Key Measures to Support a Viable Framework for Islamic Funds

Item 1 - Political Will and Cohesive Collaboration with Key Stakeholders

Key National Measure

Merits and Actionable Measures

Establish an enabler or

catalyst to produce a viable

framework for the

successful deployment of

Islamic funds

Government’s presence in promoting the successful inclusion of Islamic

funds within the financial landscape will boost and aid effective

implementation of strategies.

Key areas of review or development to support an enabling environment:

1.

Establish a dedicated entity or agency that looks at streamlining

Islamic finance activities (e.g. Malaysia established the Malaysia

International Islamic Financial Centre (MIFC) under BNM to

promote Islamic finance in the country).

2.

The specialised centre has the responsibility of identifying gaps and

market challenges, as well as engaging with market players to

identify practical solutions.