71

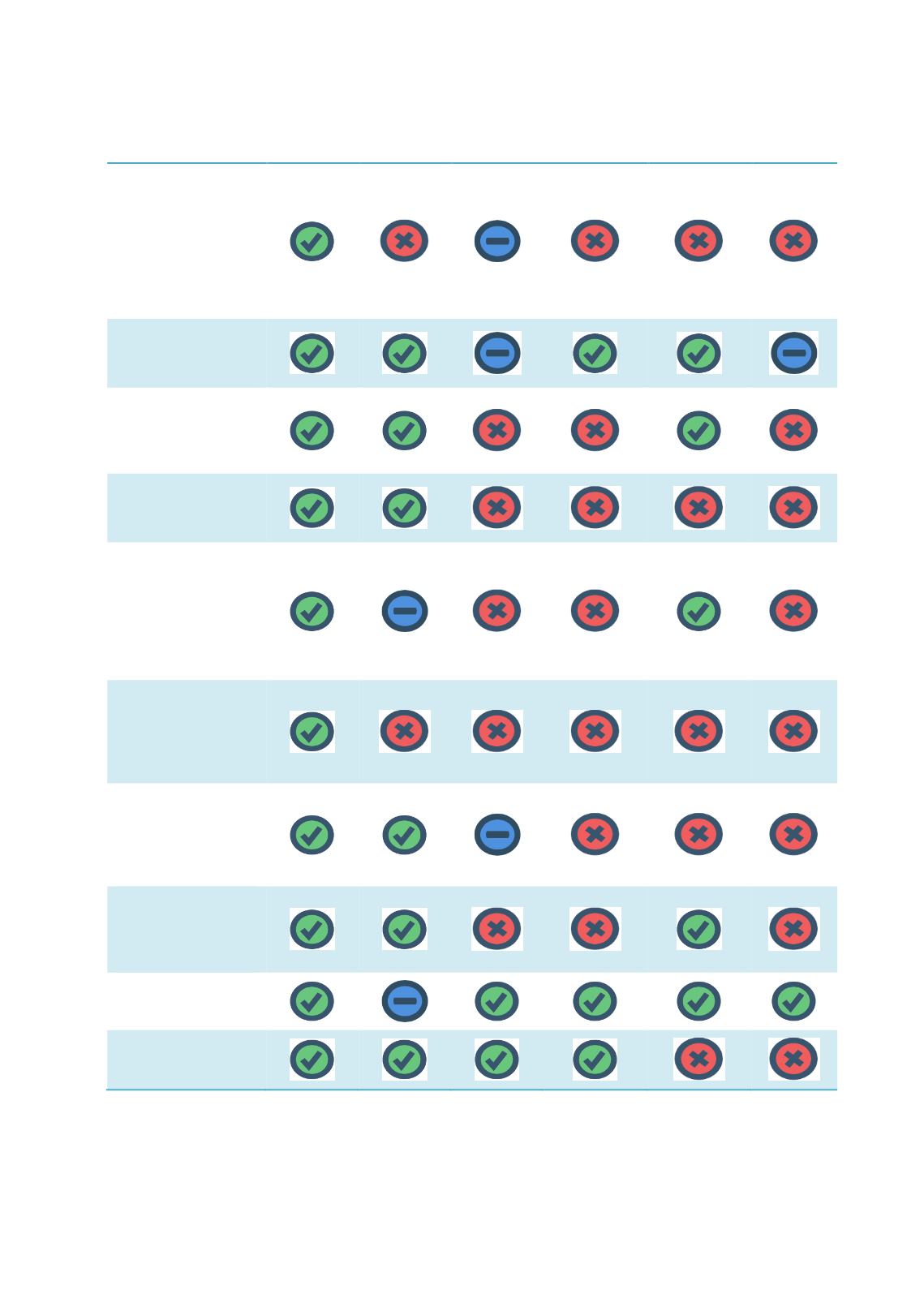

Shariah governance

framework:

-

Centralised

Shariah board

-

Resolutions on

sukuk structures

-

Key functions

such as advisory,

review and audit

Tax neutrality:

-

Removal of taxes

related to transfer

of assets

Tax incentives:

-

Waiver or

deduction of taxes

and/or issuance

costs

Product innovation:

-

Diversity in sukuk

structures and

products

Infrastructure:

-

Trading platforms

-

Listing and

approval

processes

-

Activity level of

Islamic money

market

Diversification of

investor base:

-

Intermediation by

NBFIs

-

Inclusion of retail

investors

Diversification and

frequency of:

-

Sovereign

issuance

-

Corporate

issuance

Cost

competitiveness:

-

All-in cost in terms

of legal, pricing,

issuance timeline

Establishment of a

sovereign sukuk

yield benchmark

Establishment of a

corporate sukuk

yield benchmark

Sources: RAM, ISRA