The Role of Sukuk in Islamic Capital Markets

56

Name of

issuance

Zam Zam Tower

Sukuk 2003

SABIC 1 Sukuk

2006

Dubai Islamic

Bank Sukuk

2015

Jordan

Sovereign

Sukuk 2016

Saudi

Sovereign

Sukuk 2017

Maturity

December 2027

First put option on

15 July 2011

n/a

17 October

2021

20 April

2022 and 20

April 2027

Amount

USD 390 million

SAR 3 billion

USD 1 billion

JOD 34 million

USD 9 billion

Periodic

distribution

An internal rate of

return on the

investment at

26%

3-month SIBOR +

40 bps

6.75%

3.01%

2.894% and

3.628%

respectively

Listing

n/a

Saudi Stock

Exchange

Irish Stock

Exchange and

NASDAQ Dubai

n/a

Irish Stock

Exchange

Geographical

distribution

of investors

n/a

n/a

n/a

n/a

n/a

Sources: Bloomberg, Thomson Reuters,

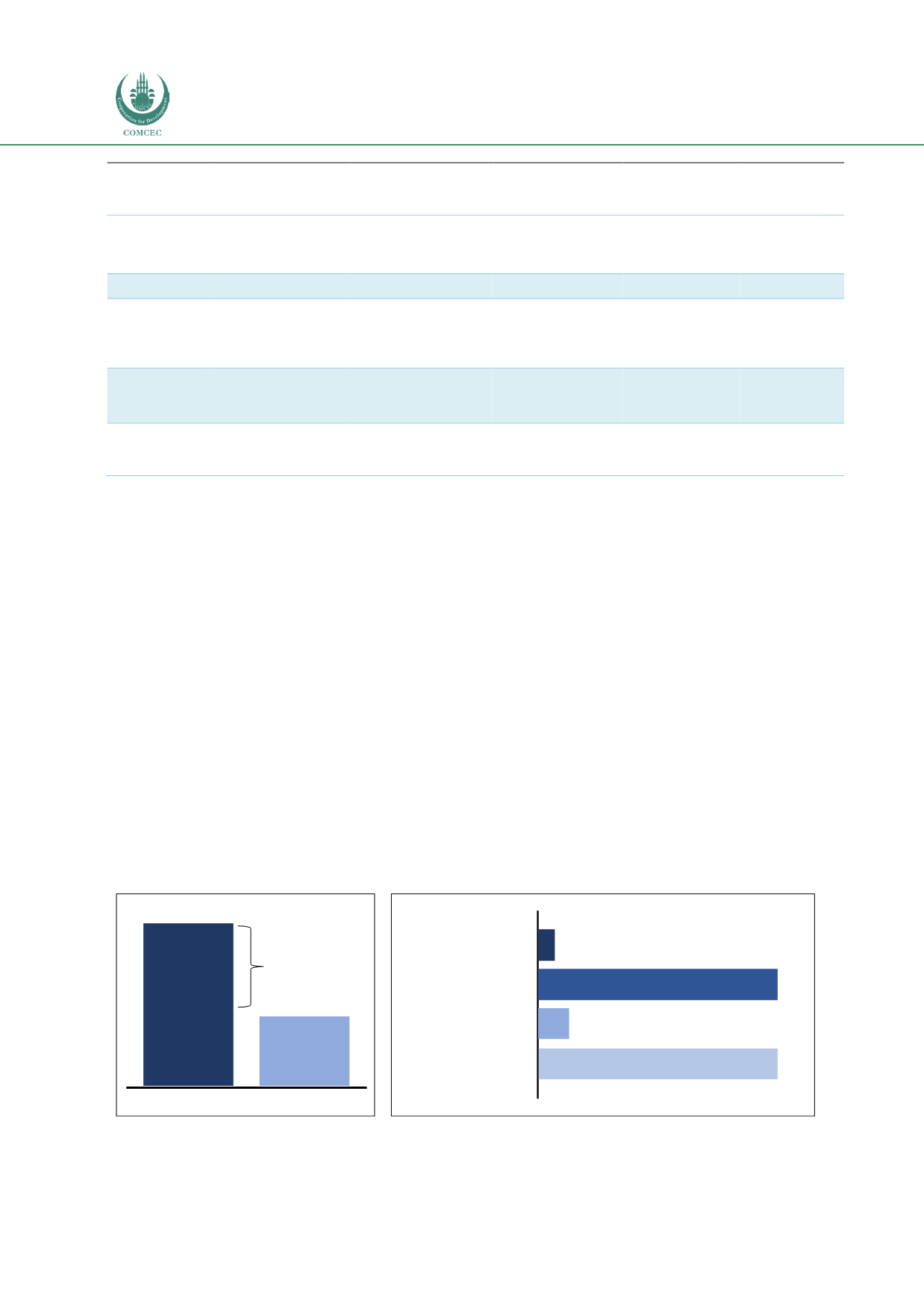

sukuk.comIn developing Arab countries’ sukuk markets, consideration should be given to the large

infrastructure funding gap that has historically been funded by governments and commercial

banks. As Arab governments look into economic reforms (i.e. cut-backs on subsidies and

government spending) the silver lining amid the need to reduce dependency on oil revenue is

the promotion of economic growth through public-private-sector relationships, which will lead

to spill-over effects for the economy (e.g. increased construction activities, manufacturing, and

job creation). As depicted in Figure 3.6, Arab countries face an annual USD60 billion funding

gap.

Research shows that the GCC governments are increasingly turning to public private

partnerships (PPPs) to plug the budgetary gaps in public-transport infrastructure

development amid fluctuating oil prices. The 2 key markets generally considered as the most

promising in the near term are Kuwait and the UAE (i.e. Dubai), each of which recently adopted

a legislative framework for PPPs. Saudi Arabia’s government has also decided to implement

several transport infrastructure projects based on the PPP model (Gulf Traffic, 2017).

Figure 3.6: Arab Countries’ Infrastructure Spending

Water and

Sanitation

Transport

Information and

CommunicationsTechnology

5%

Electricity

9%

43%

43%

Annual funding gap of

USD60.0 billion

Investment Requirements Current Spending

USD40.0 billion

USD100.0 billion

Infrastructure financing gaps

Priority sectors for the next 5 years

Source: Arab Monetary Fund Calculation (2016)