The Role of Sukuk in Islamic Capital Markets

38

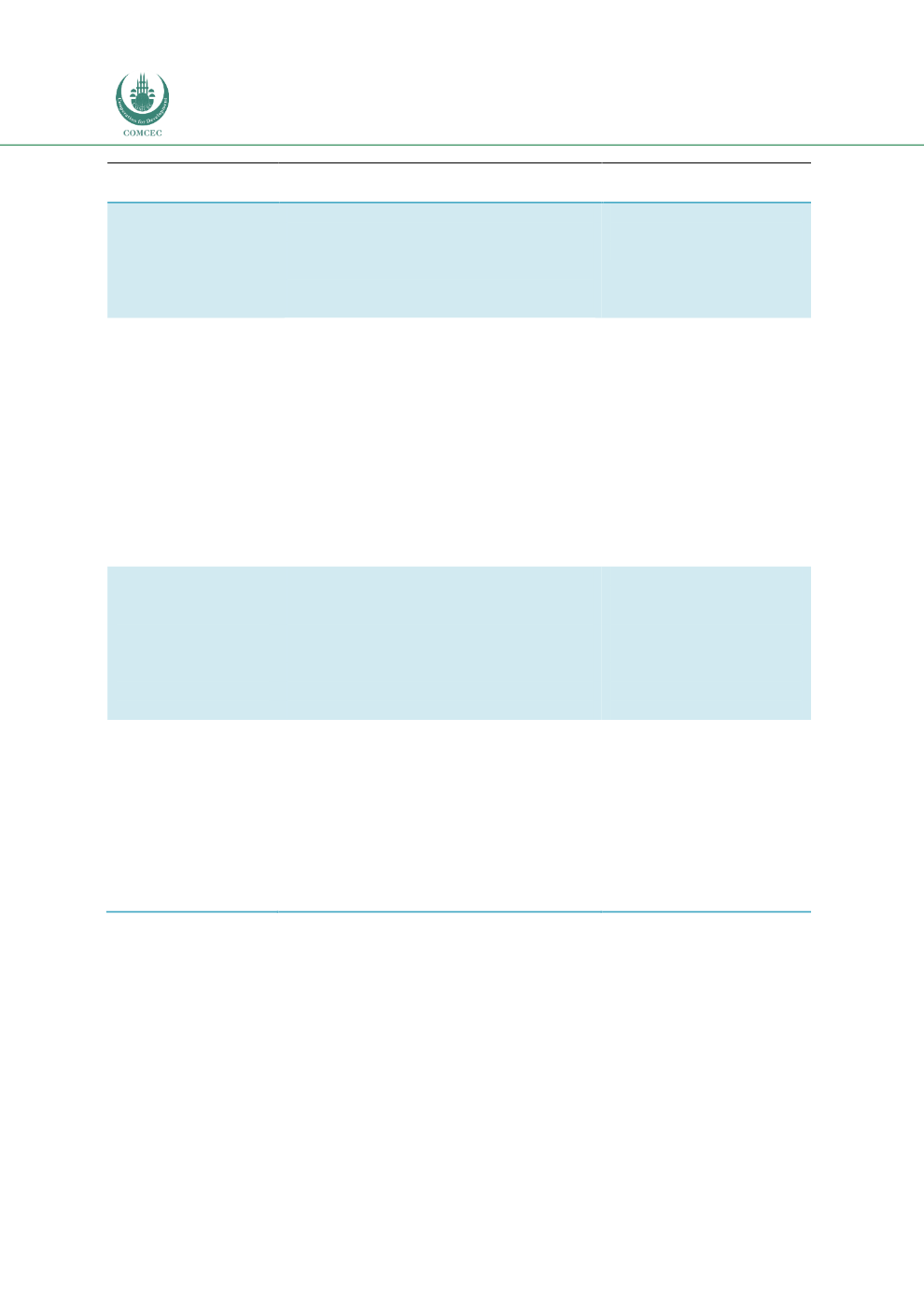

Market stakeholder

Examples of development actions

Impact on capital

markets

Exchanges

Issuer-friendly listing requirements in

terms of documentation and processes.

Provide incentives for sukuk compared

to conventional bond issuance, in terms

of listing fees and expenses.

Encourage good corporate governance.

Generate confidence

among existing and

potential investors.

Service providers

(e.g. investment

banks, securities

companies,

advisory houses,

brokers, traders,

rating agencies)

Collaborate with regulators in building

market awareness of sukuk, issuance

processes, tax-related issues and

benefits, and timelines, among others.

Market maker to identify potential sell-

side and buy-side clients for ICM

products and provide liquidity through

market participation.

Capacity building in human

development to facilitate ICM talent

management.

Diversify products to meet the various

financing objectives of market players.

Stimulate product

development in both

the sell and buy sides.

Provide strong talent

base to develop

innovative products

that appeal to the

international

community.

Non-bank financial

intermediaries

(NBFIs) (e.g.

institutions,

pension funds, asset

and wealth

managers, private

bankers)

Develop strong market appetite for

long-dated debt securities and

encourage project-based funding.

Acceptance of lower-grade investment

credits (high-risk, high-return

mentality) to allow mid-cap companies

to tap the capital markets.

Facilitate issuance of

infrastructure-based

sukuk with maturities

exceeding 7 years.

Develop price guidance

for corporates across

the entire investment-

grade rating spectrum.

Financial

institutions and

their holding

companies

Encourage development of capital-

market instruments as potential

financing substitutes.

Create a sustainable supply of sukuk to

finance capital-adequacy requirements.

Define a strategy and operational model

that provides value-based guidance to

clients between balance-sheet financing

and capital markets.

Promote value creation

through capital-market

activities to enhance

shareholder value.

Promote efficient use of

capital between

business lines.

Generate capital-market

activity on both the sell

and buy sides.

Source: RAM

As explained in Table 3.1, NBFIs are the cornerstone institutional investors, apart from

financial institutions, that can elevate the growth of the sukuk market to the next level. Box 3.2

provides the World Bank’s definition of NBFIs.