115

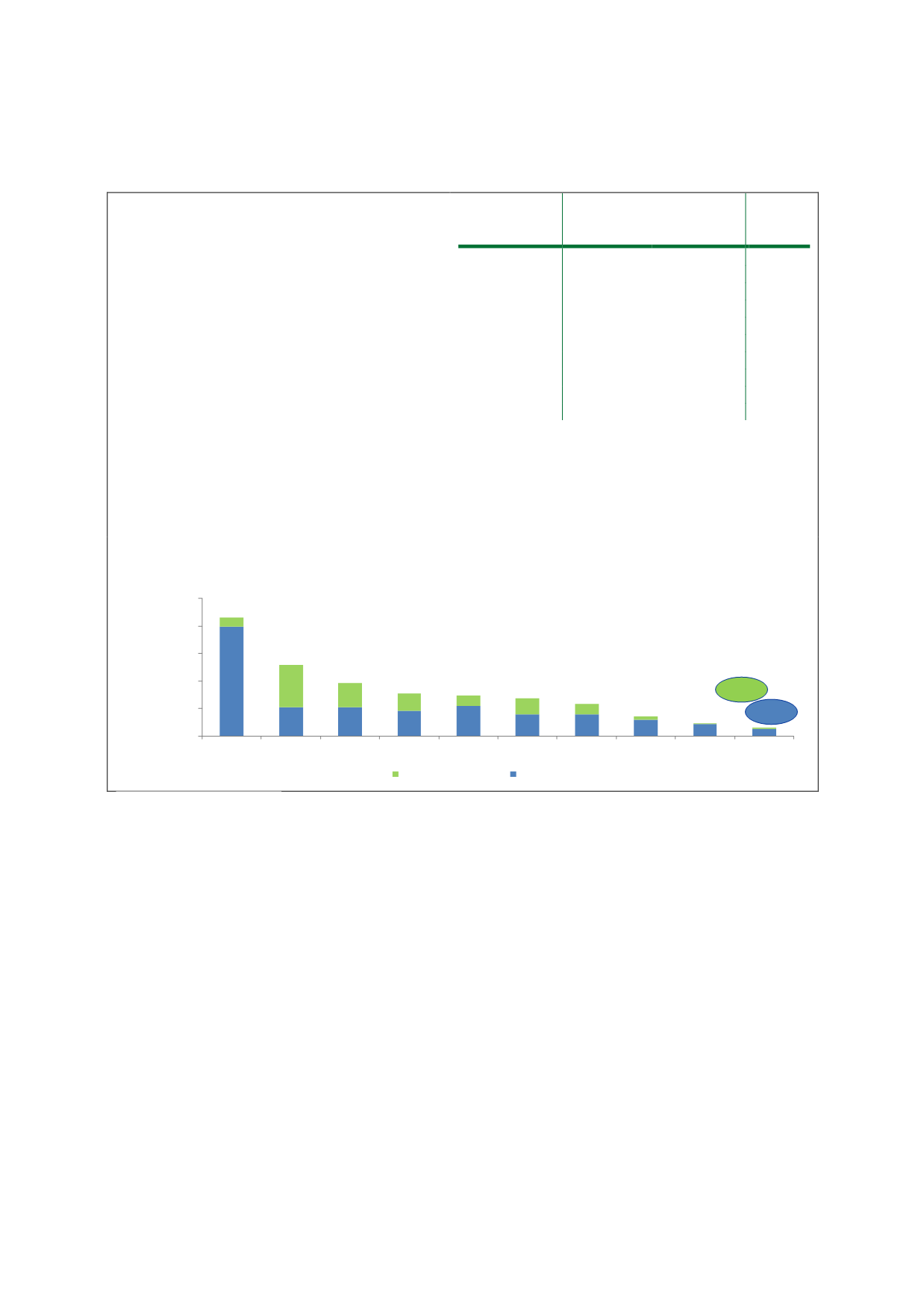

Box 4.6: Size of Selected Asian Debt Markets as at end-2016 (USD billion)

Development of Indonesia’s domestic bond

market

The government and regulators are working

together to develop the domestic bond market, and

have made it a key priority in their capital market

masterplans. The ability to reduce the country’s

reliance on foreign debt holders will reduce the

impact of volatility arising from sentiment-driven

foreign investors. The strategies that have been

successfully implemented include the launch of

government retail bonds in 2006 and the inclusion

of Islamic finance products in 2008. Over the years,

Indonesia’s bond market has grown steadily,

recording USD163.0 billion of outstanding bonds as

at end-2016, mainly comprising government

issuances which accounted for 85% of total

outstanding bonds; the remainder were held by the

corporate sector.

Corporate

bond

market

Government

bond

market

Total

Japan

670.8

8,965.8 9,636.6

China

2,155.0

4,974.0 7,129.0

Korea

1,010.9

702.0 1,713.7

Thailand

81.5

221.5

303.0

Malaysia

119.0

141.2

260.2

Singapore

99.0

137.0

236.0

Hong Kong

97.0

133.0

230.0

Indonesia

23.0

139.0

163.0

Philippines

18.0

80.0

98.0

Vietnam

2.0

42.0

44.0

Size of Selected Debt Markets Relative to GDP (as at end-2016)

0.0%

50.0%

100.0%

150.0%

200.0%

250.0%

Japan

Korea Malaysia Singapore Thailand Hong Kong China Philippines Vietnam Indonesia

% ofGDP

Private Sector

Public Sector

14%

85%

Source: Asian Bonds Online

There is a significant difference in the currencies of debt issued by the government as opposed

to corporates. The ratio of domestic debt relative to the government’s total debt has been

trending downwards, from a high of 24% in 2015 to about 17% as at end-June 2017 (refer

Chart 4.31). The government’s aim of refinancing maturing foreign debts by issuing

bonds/sukuk in the domestic market supports the achievement of better pricing benchmarks

in its own currency, a sound balance between foreign and domestic debts, and the

strengthening of the domestic financial market. Meanwhile, Indonesian corporates have

instead relied heavily on FCY bonds to meet their financing requirements (refer to Chart 4.32).