92

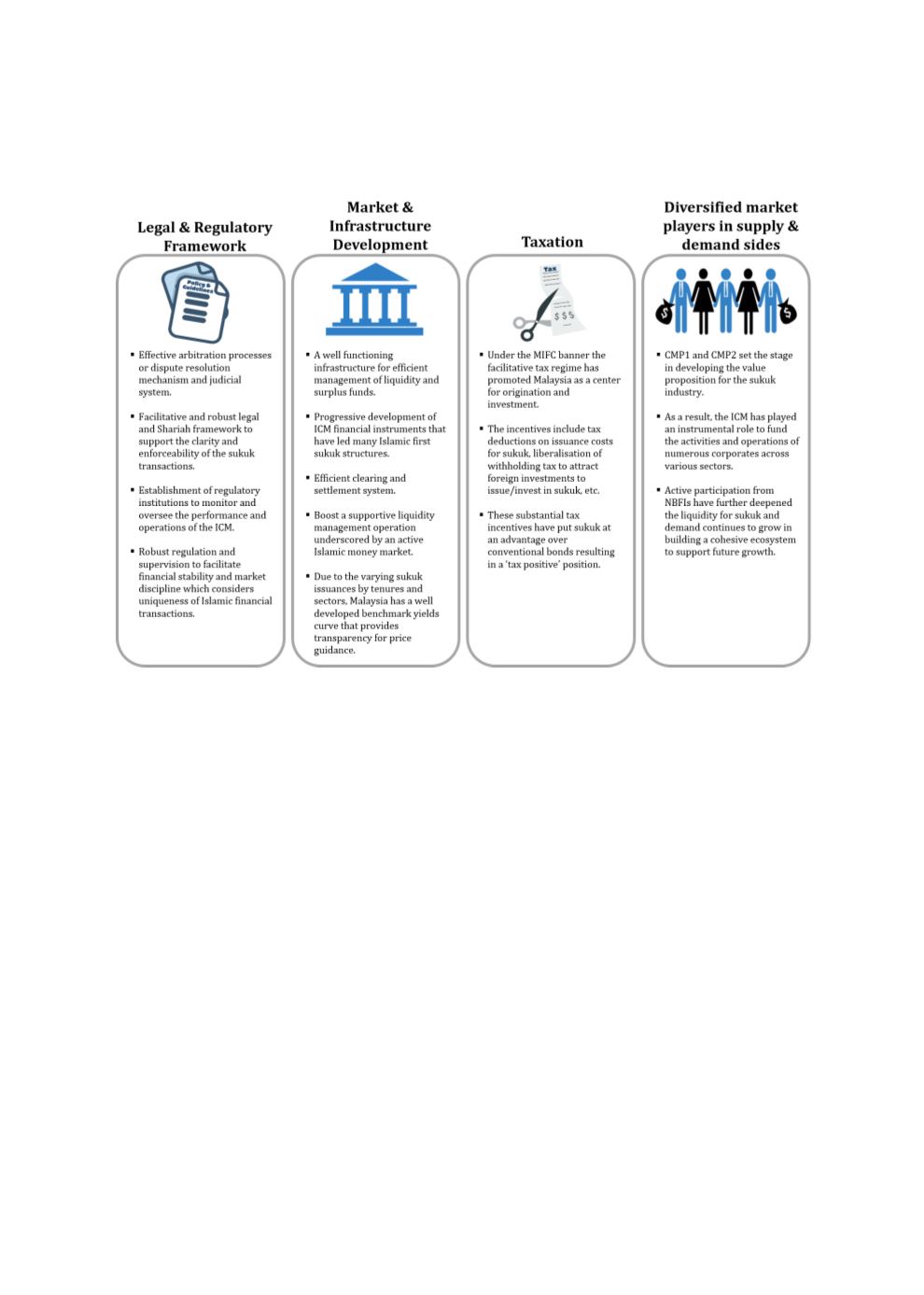

Figure 4.5: Key Factors Underpinning the Growth of Malaysia’s Sukuk Market

Sources: RAM, ISRA

In terms of financial engineering, Malaysia’s sukuk landscape has seen pioneering structures

that have spearheaded the country’s leadership in terms of product and structure innovation.

Examples include structural enhancements for tax efficiency, Shariah compliance and to

support higher credit ratings. In 2016, Khazanah Nasional Berhad raised USD398.9 million of

exchangeable sukuk that can be converted into shares of Beijing Enterprises Water Group Ltd

(BEWG). The uniqueness of the structure allows Islamic investors to participate, as Khazanah

will satisfy any exchange via a cash settlement if BEWG shares do not meet the financial ratios

for Shariah compliance, as set by the Dow Jones Islamic Market Index and the FTSE Shariah

Global Equity Index Series on the date of the exchange. Similarly, Malaysia Building Society

Bhd’s (MBSB) USD931.3 million (or RM3.0 billion) covered sukuk was issued in 2013 – the

world’s first such issuance. Sukuk investors are entitled to claims on the issuer and the assets

backing the structure (i.e. dual-layer security).

Malaysia’s advancement in Islamic finance has taken more than 30 years to achieve. Figure 4.6

encapsulates several developmental phases that Islamic finance has undergone since its formal

inception in 1983, and its expected evolution in the coming years.