COMCEC Transport and Communications

Outlook 2018

30

Although such a situation is a common trend in today’s globalized shipping industry, this often

leads to high maritime transport costs and low shipping connectivity particularly for the OIC

countries with smaller economies located in remote locations (COMCEC, 2015).

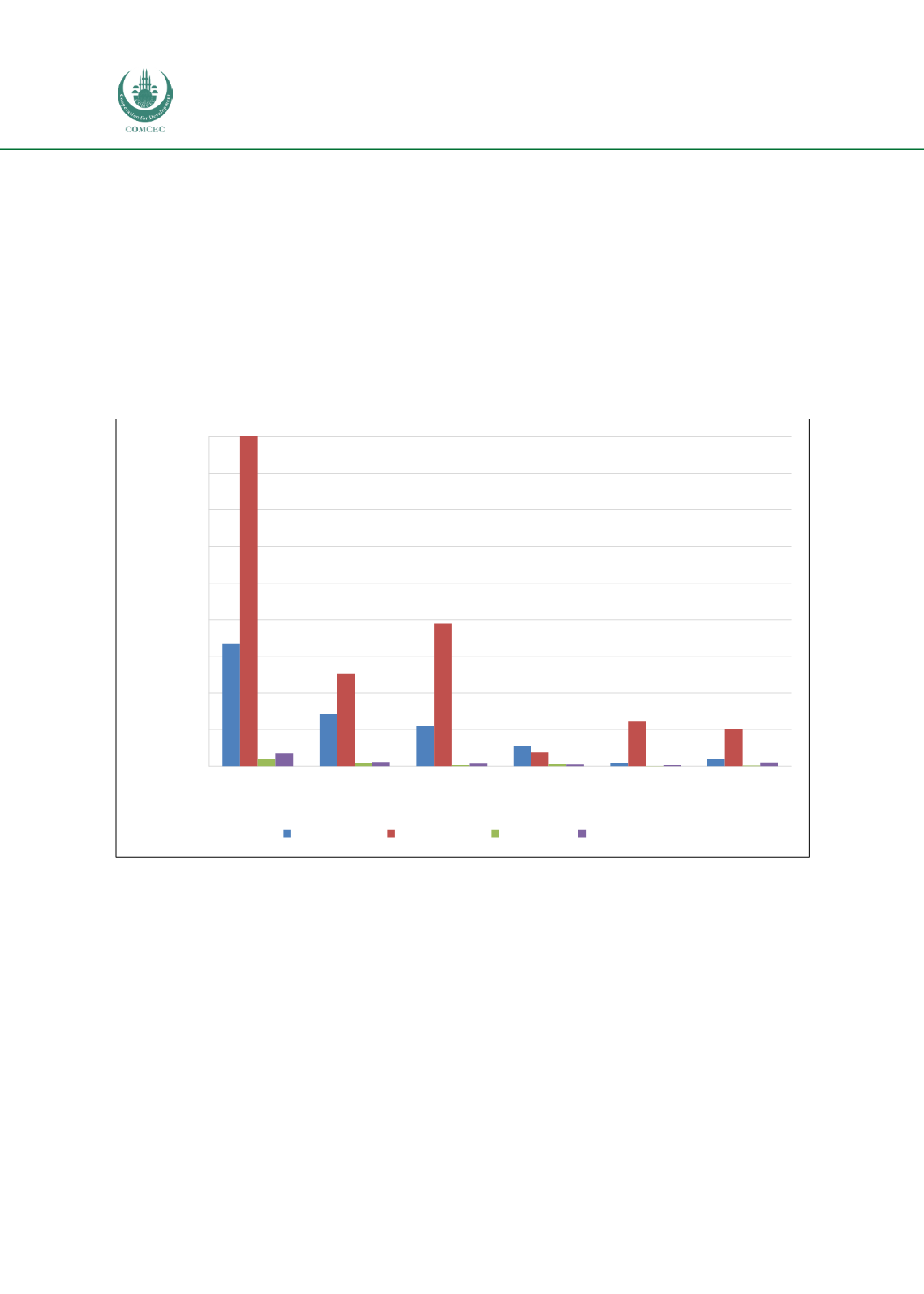

Figure 14 compares the share of OIC fleet in the global fleet by ship’s type in 1985 and 2016,

respectively. The figure reveals that the OIC’s share of general cargo ships is currently 12.5% of

the world’s general cargo fleet, while the OIC share in the global bulk and tanker fleet is only

1.7% and 4.4%, respectively. This is surprising considering the trade in many OIC countries are

mainly dominated by bulk and fuel commodities (COMCEC, 2015).

Figure 14: OIC and global commercial fleet by type of ship (1985 and 2016)

Source: Compiled by the author from UNCTAD Statistical Database

Table 8 presents the commercial fleet capacity of the OIC countries. Between OIC countries,

there is a great disparity in ship ownership and operation. In 2018, Indonesia had the largest

commercial OIC fleet capacitywith a total tonnage of 22.3million dwt. Other countries with large

fleets include Saudi Arabia (13.5 million dwt), Malaysia (10.2 million dwt), and Turkey (7.7

million dwt). At the other end of the scale, some OIC countries such as Afghanistan and Mali have

no commercial fleet while others like Benin and Somalia have negligible tonnage despite the

importance of their maritime trade related sectors.

-

200.000

400.000

600.000

800.000

1.000.000

1.200.000

1.400.000

1.600.000

1.800.000

Total fleet

Oil tankers Bulk carriers General cargo Container

ships

Other types of

ships

World 1985 World 2016 OIC 1985 OIC 2016