Improving Transport Project Appraisals

In the Islamic Countries

83

Beyond the 5-year Development Plan, transport mode-specific

masterplans

are in place in Iran,

prepared under the responsibility of the Ministry of Roads and Urban Development (MRUD) and

its affiliated organisations and companies, among which the Construction and Development of

Transport Infrastructure Company (CDTIC), the Railways of the Islamic Republic of Iran (RAI)

and the Ports and Maritime Organisation (PMO). For the preparation of mode-specific

masterplans, different scenarios are tested and an economic study is carried out by the MRUD

assessing the impact of the plan on the national GDP. Once a list of project ideas has been deemed

suitable for being included in the masterplans based on the preliminary economic study, further

analysis is required at project level.

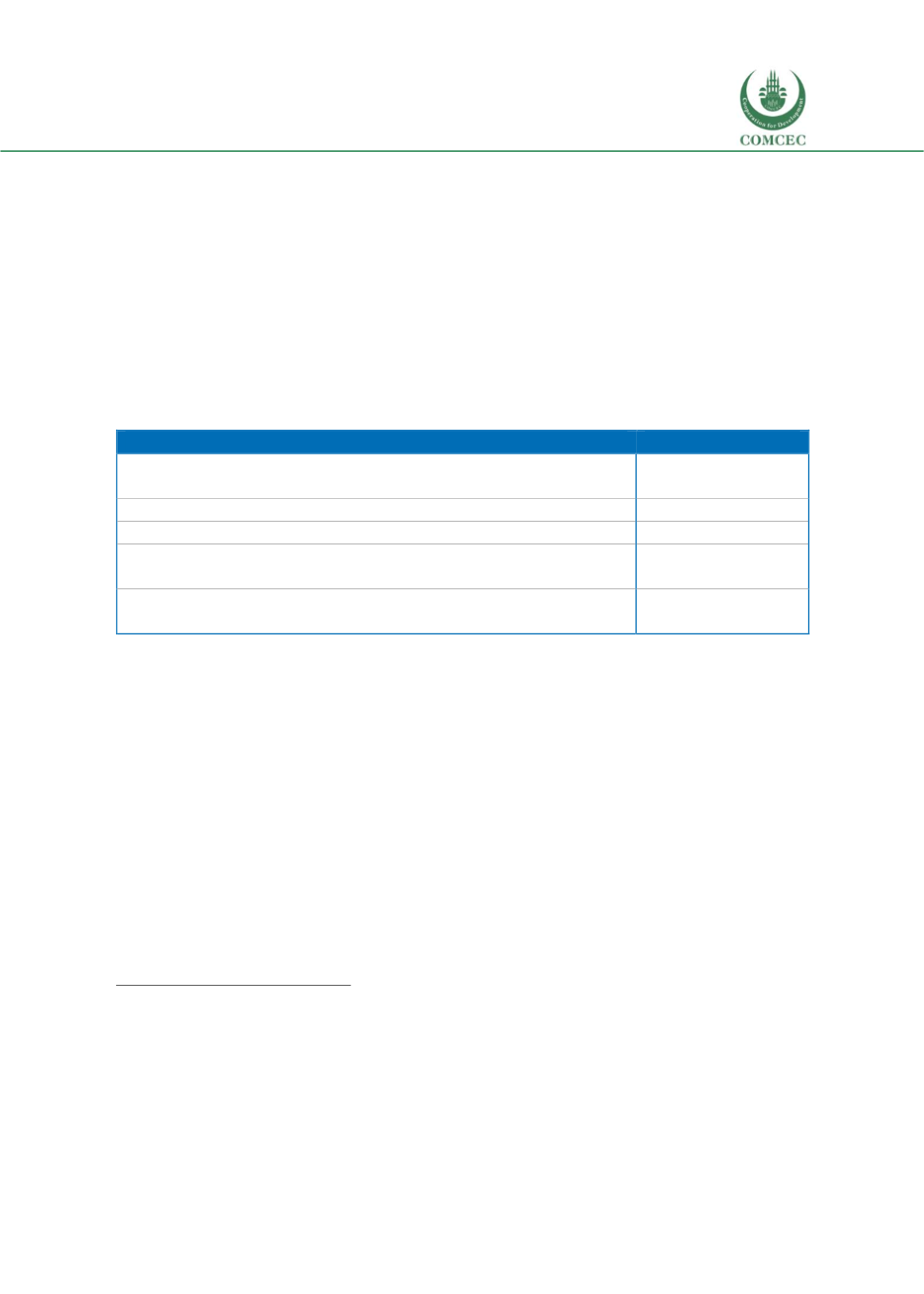

Table 5.1: Most relevant organisations and companies affiliated to the Ministry of Roads and

Urban Development

Organisation/Company

Mode of transport

Ports and Maritime Organisation (PMO)

Maritime

transport

Railways of the Islamic Republic of Iran (RAI)

Rail transport

Roads Maintenance and Transport Organisation

Road transport

Construction and Development of Transport Infrastructures

Company (CDTIC)

Rail and road

transport

Civil Aviation Organisation; Airport and Air Navigation Corporate

Holding Company; Iran Air

Air transport

Source: CSIL.

In Iran, transportation investments can be of three types:

1)

Government-based projects

, either funded directly by the government annual budget or

based on sovereign guarantee

46

through Engineering, Procurement, Construction and

Financing schemes (EPCF)

47

;

2)

Public-private partnerships (PPPs)

48

, in the form of project finance called Build–Operate–

Transfer (BOT) or Build–Lease–Transfer (BLT). BOT scheme (see figure below) is the most

frequently used, representing 90% of all PPP arrangements;

3)

Lease contracts to industries

, i.e. totally private investments, for which the government can

provide concession of land.

46

With the Sixth Development Plan the Government has been authorised to issue guarantees for foreign investments in

projects in Iran’s private sector that meet certain requirements including economic justifications, technical feasibility,

and the approval of the High Economy Council. This is in line with the decree issued on February 2017 by Iran’s Council

of Ministers authorising the Minister of Economic Affairs and Finance to issue sovereign guarantees for certain eligible

projects.

47

Under these schemes, a private entity bids for the tender in order to design, finance and execute an infrastructural project

on behalf of government. Operation is not part of these schemes.

48

A contract between private entity and government to execute infrastructural projects like freeways, motorways, railways,

etc. Salient features of these models are that private entity will bear the entire cost of executing the project and they gain

the revenues from operating it.