Improving Customs Transit Systems

In the Islamic Countries

154

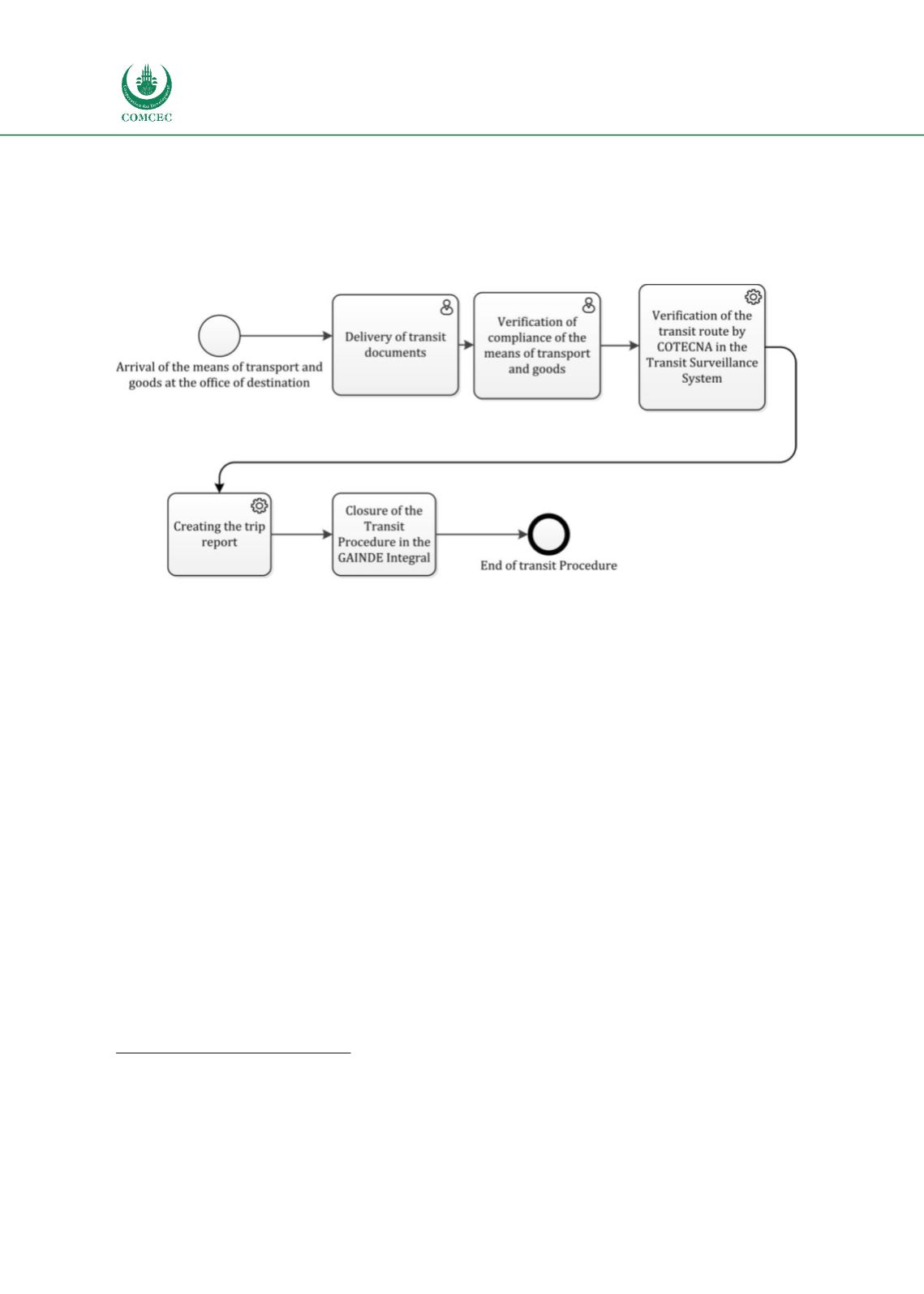

At this level, it is notable that there is a huge delay in the transmission of information from the

border crossing points to the SC HQ, delaying the closing of transit procedure and the release of

the guarantee. The customs agents are sometimes obliged to send this information to SC,

whereas it is the Customs officers themselves who should do so.

Figure 39: End of the transit procedure

Source: Senegalese Customs

There are no taxes or charges to be paid in Senegal for transit. Only the COSEC

96

related to

maritime transport is paid if the goods have arrived by sea.

With the implementation of West African Economic and Monetary Union UEMOA Regulation 14

on axle load, require weight control at the exit of the PAD and at border crossing points.

It should be noted that this weight control is not only for consignments in transit but applies to

import and export consignments.

4.2.5.1

Single Transit Document (T.I.F)

In the context of the convention signed between the Republic of Senegal and the Republic of

Mali, for the transit using the railway, a simplified transit declaration model called T.I.F is

adopted in this framework managed by the Senegalese National Railway Company.

4.2.5.2

Single Transit Document (T.I.R)

T.I.R

97

is a customs regime that applies to the transit of consignments by road, and it can be used

on one or more borders without in transit. Single transit document is used within the signatory

9

6 Conseil sénégalais des chargeurs (COSEC) - Senegalese Council of Shippers97

Le Transit International par Route