Strengthening the Compliance of the OIC Member States

to International Standards

74

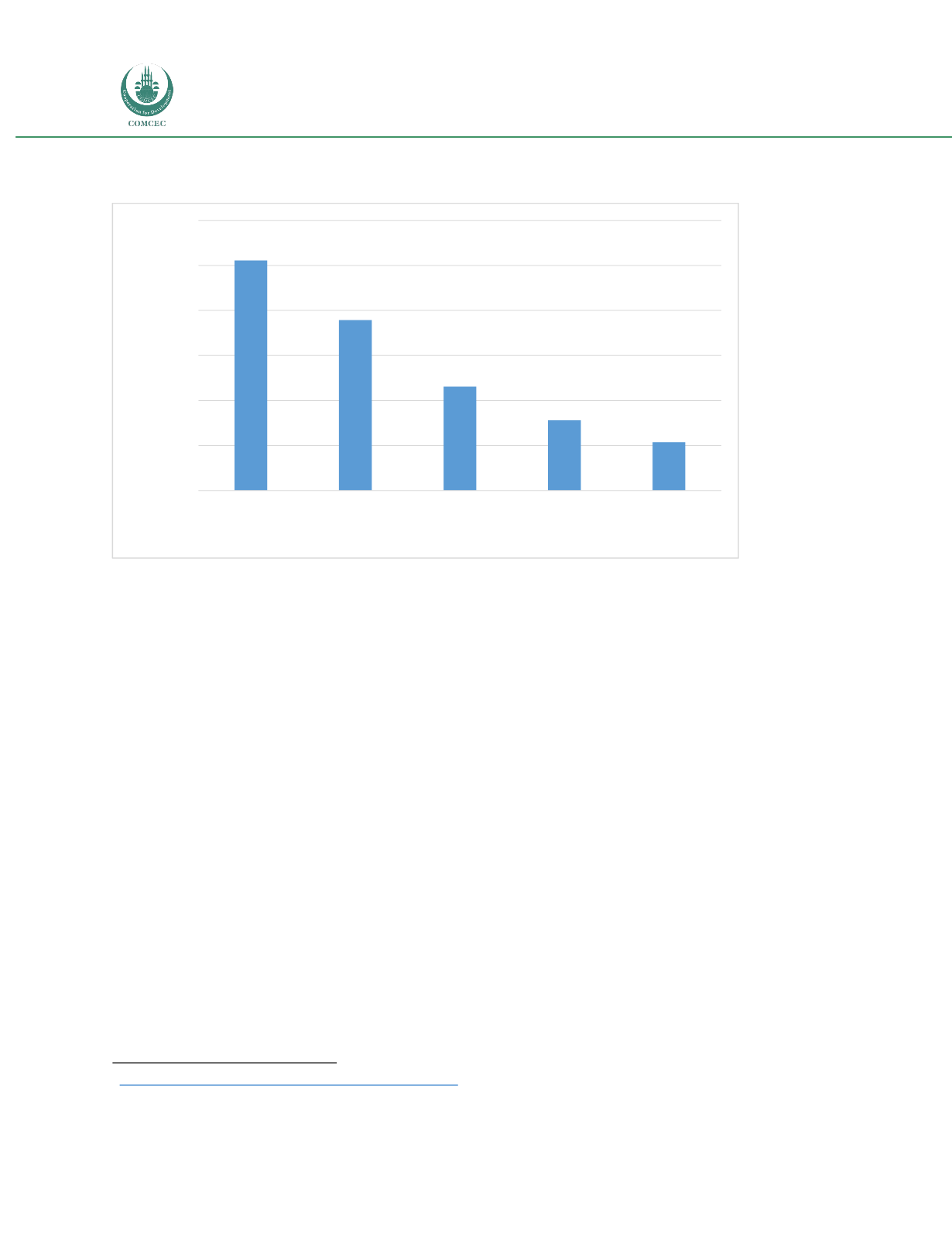

Figure 36: Top five export markets for Bangladesh, 2011.

Source: WITS-Comtrade.

The garment and textile sector in Bangladesh—where standards issues loom large—accounts for $19

billion in annual exports, which equates to 80% of total export earnings and 20% of the country’s GDP.

The industry employs 4.2 million workers—mostly women—in formal private sector jobs in more than

4,500 factories (IFC, 2014). The Bangladesh readymade garment (RMG) sector accounts for 5% of the

world RMG export market, with leading global garment buyers increasingly relying on Bangladesh to

meet their needs, especially at the lower end of the value chain.

In its most recent Trade Policy Review for Bangladesh, the report by the WTO Secretariat (2012)

attributes the RMG sector’s standing largely to its price competitiveness (especially for low value RMG

products), the duty-free quota-free access that RMG products enjoy in Bangladesh’s major markets (EU,

Japan, Australia) owing to the country’s LDC status, and the government’s export promotion measures.

That said, according to the Bangladesh Textile Mills Association (BTMA)

4

, “out of 3500 RMG factories

over 2000 are already complying with the international standard. Many of these factories have obtained

international standard certificates like ISO-series, GFSI and FSSC. On the basis of these certificates

Bangladesh RMG factories are now on top in the list of buyers.” McKinsey and Company (2011) A 2011

report by McKinsey and Company also mentions that the Bangladesh RMG sector “provides satisfactory

quality levels, especially in value and entry-level mid-market products”.

4 http://www.bangla-expo.com/DTG/newsDetail.asp?serno=5060

1000

2000

3000

4000

5000

6000

United States

Germany United Kingdom France

Spain

Million USD

Market