91

Private Sector Perspective

The AEO program aims not only to enhance international supply chain security but also to

facilitate legitimate trade. To be precise, AEO holders get considerable benefits from reduced

costs and expedited processes in daily transport, export and import operations in terms of

labor and time.

Due to increasing importance of foreign trade and Customs matters, budgetary appropriations

to training, auditing and self-control of the employees have increased considerably in the AEO

holder companies.

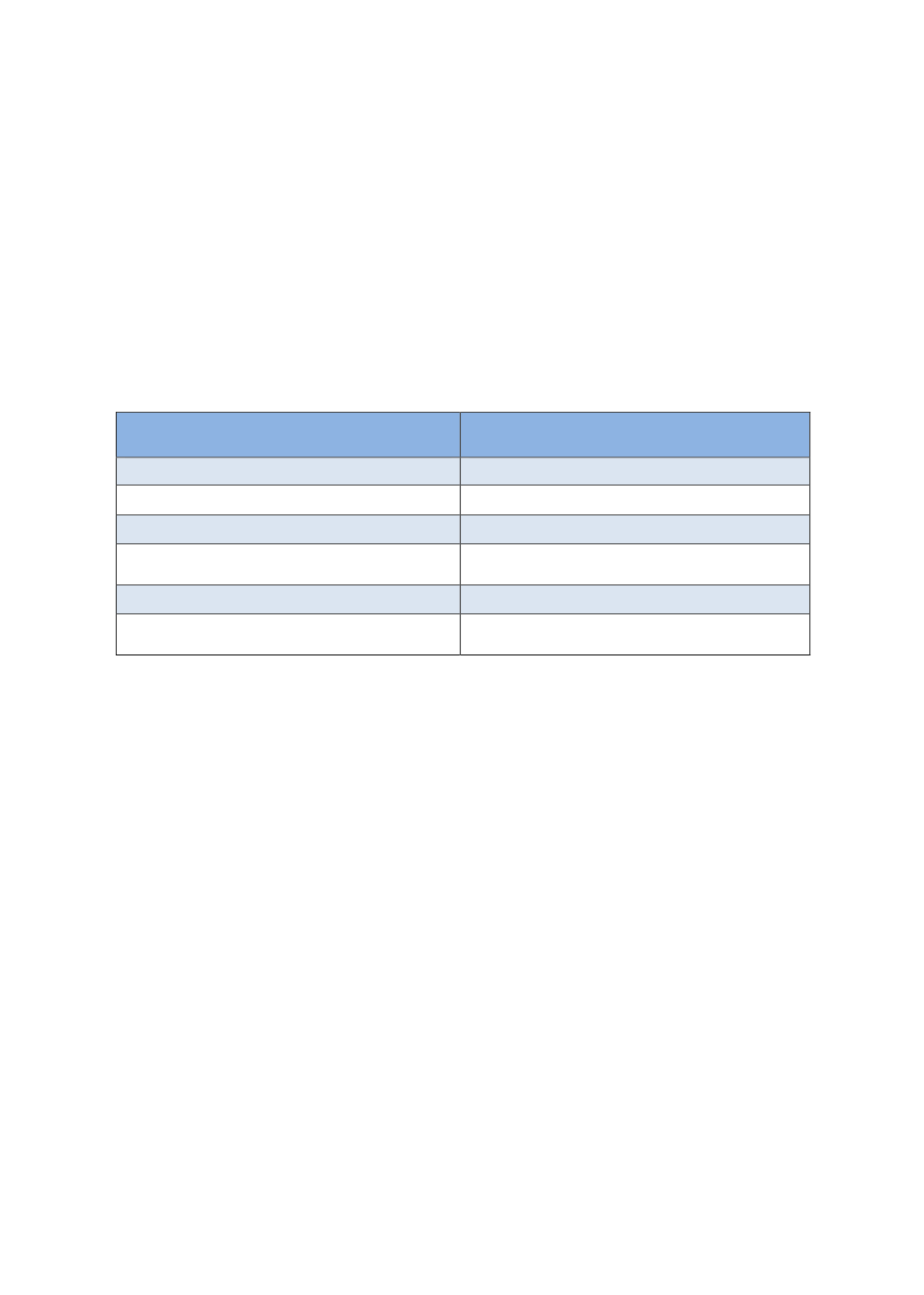

Table 4.5. Trade Facilitation Benefits of the AEO Program

Facilitations for all AEO holders

Facilitations for AEO holders with

additional conditions and/or applications

Summary declaration with reduced data

Local clearance in exporting

Fewer documentary and physical controls

Local clearance in importing

Control priorities

Authorized consignor

Submission of incomplete declaration and

documents

Authorized consignee

Using lump-sum and partial guarantees

Issuing

A.TRcirculation documents

Green-line facilitations (including on free

alongside ship declarations)

Issuing EUR.MED invoice declaration

Source: Authors’ own compilation from Ministry of Trade

Some important indirect benefits of the AEO status are visible improvements in the internal

control, security and safety of the company premises, IT systems and archives as well as the

development of related new software.

4.2.3. Implementation

In the Ministry of Trade, Directorate General of Risk Management and Control, the “Trade

Facilitation Department” is in charge of the implementation of the AEO Program in Turkey.

The AEO program is promoted through the website of the Ministry of Trade, manuals and

brochures (printed and online) and online promotional videos.

4.2.3.1. Application

In Turkey, the application procedures start with companies that request certification by

applying to the Regional Customs and Trade Directorates of the place where they operate

(Figure 4.3). The following documents have to be present at the time of application: the

application form, the self-assessment questionnaire, the criminal record certificates of top

management and Customs related employees, self-certification of top management and

Customs related employees, tax-clearance certificates, certified public accountant reports and

certificates of ISO 9001 and ISO 27001.