National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

65

An interesting feature in Bangladesh is the role the industry has played in the establishment of

some of the infrastructure institutions. With the encouragement and support of BB, Islamic

banks have taken initiatives to establish a Central Shariah Supervisory Board and interbank

Islamic money market.

There have been no initiatives to develop the legal and regulatory regime for takaful

companies and Islamic capital markets. As a result, takaful companies operate at a

disadvantageous level compared to their conventional counterparts. While both stock

exchanges have developed Islamic indices, no sukuk have been issued. The relatively

underdeveloped sukuk and Islamic capital markets also highlight the complementarity

between different financial sectors whereby both Islamic banking and takaful sectors face

constraints to growth due to a lack of adequate Shariah compliant liquidity and investment

instruments.

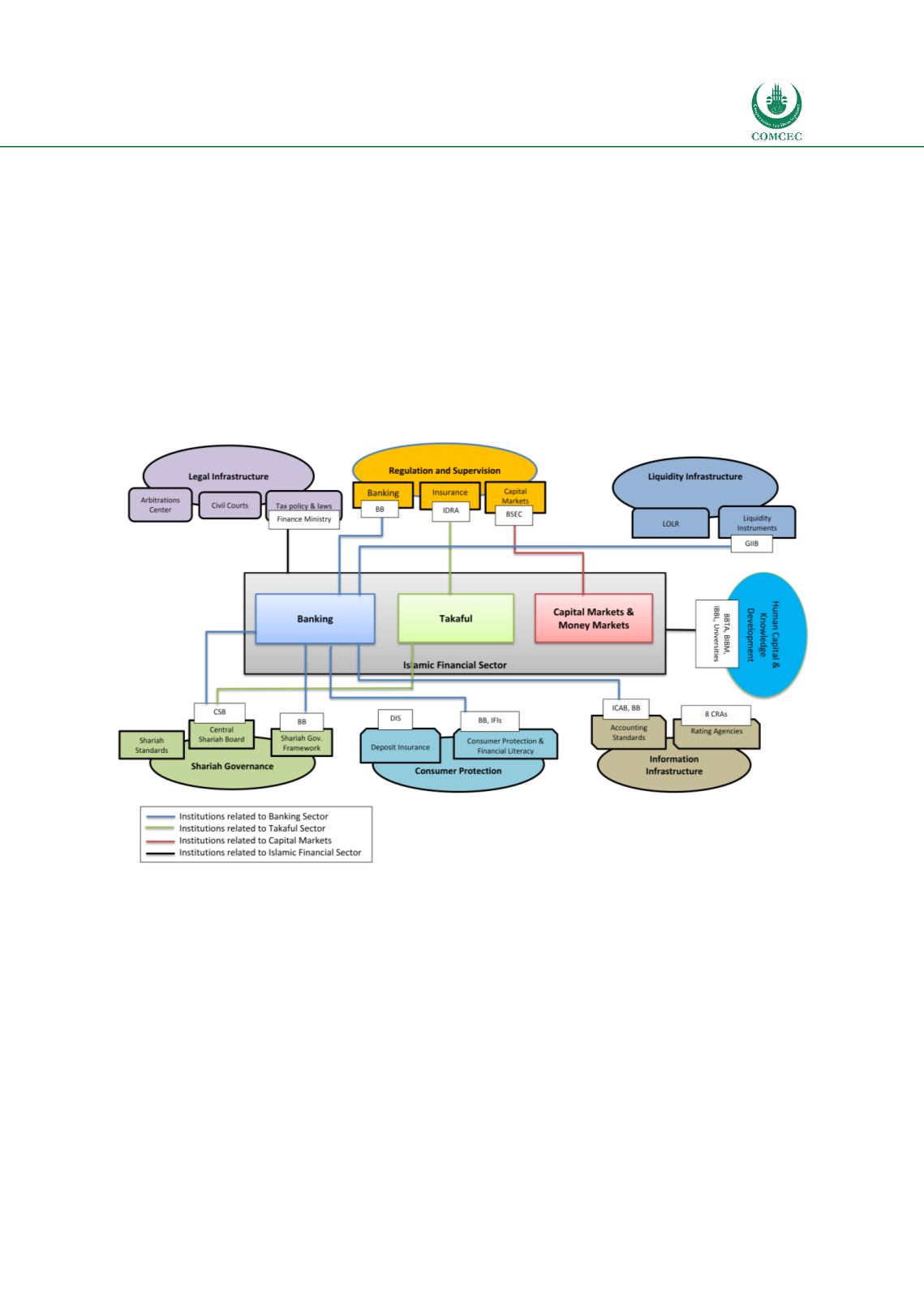

Chart

4.1: Islamic Financial Architecture Institutions—Bangladesh