National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

109

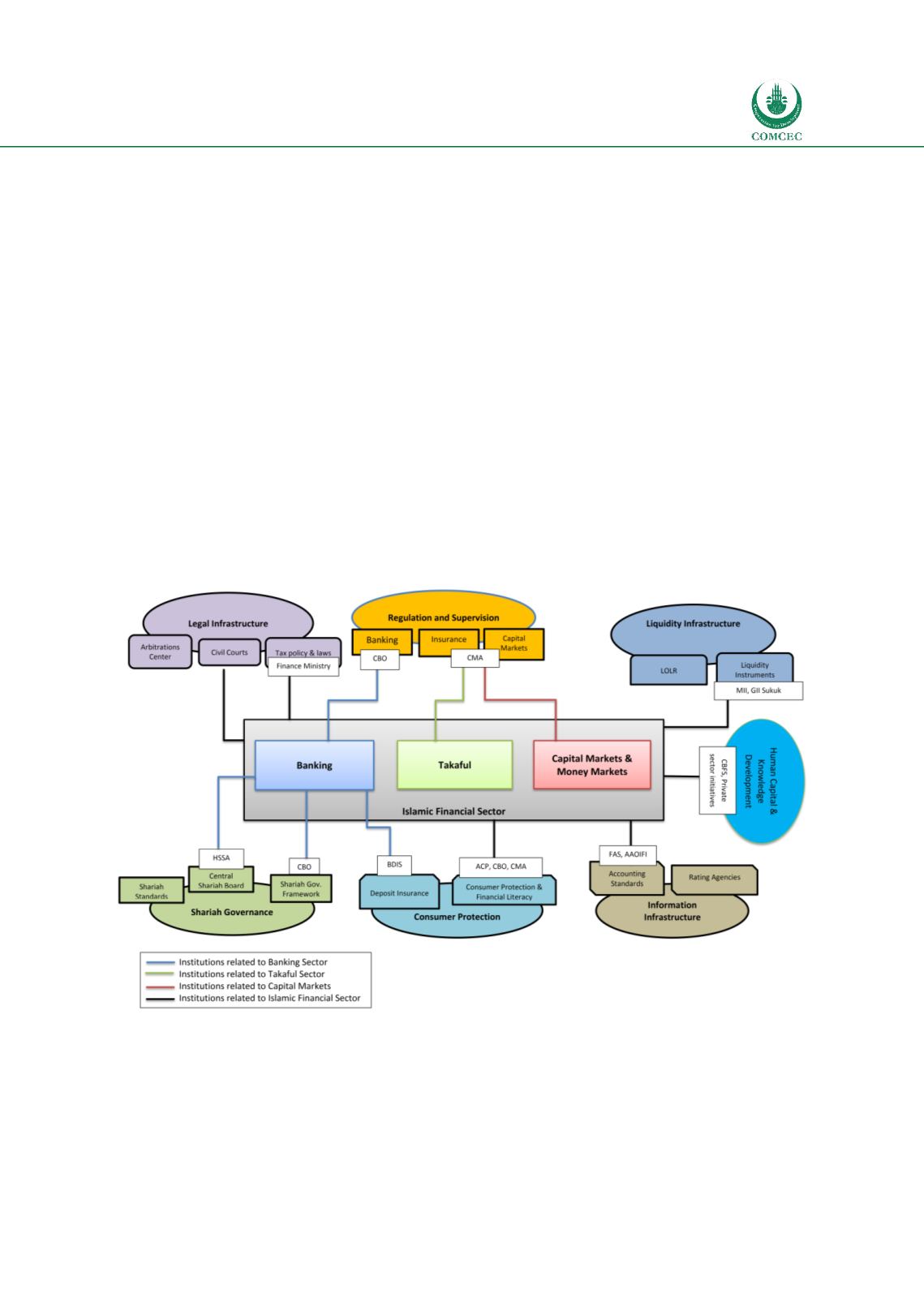

4.6.8. Summary and Conclusions

Although Oman started late in offering Islamic Banking and Takaful compared to other Gulf

Cooperation Council (GCC) countries, it is has a good start with a sound infrastructure. It has

an advantage from the experience of GCC countries and their practices in Islamic finance. The

government has shown an interest and given support to it during last three years that has

resulted in rapid growth of the sector in the country. The legal and regulatory infrastructure

for Islamic finance includes laws and regulations for Islamic banks, takaful companies and the

Islamic capital market. In addition, the Central Bank of Oman (CBO) currently is working on an

insurance scheme for depositors of Islamic banking and the Capital Market Authority (CMA)

has prepared Sukuk Regulation which is in its final stage of approval. Also, there is a High

Sharia Supervisory Authority (HSSA) which provides opinions and expert advice on Sharia

matters to the CBO. The government of Oman has shown interest for continuous development

of Islamic financial institutions and markets both on the demand and supply sides. Other than

laws and regulation to support the industry, it has sponsored different training programs and

hosted different conferences to raise awareness of the public. Along with government

initiatives, Islamic banks and widows are also contributing to different educational events such

as conferences, seminars and training programs to raise an awareness of Islamic banking and

finance in the country.

Chart

4.6: Islamic Financial Architecture Institutions—Oman