National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

101

prospects for growth. The sub-sector is, however, being challenged by a lack of adequate

Islamic finance architecture. The legal environment is still not fully developed to effectively

support the workings of Islamic finance. The legal system limits the ability of the regulatory

bodies, such as the CBN to come up with robust liquidity management instruments thereby

leaving the Islamic financial institutions in a disadvantageous position in managing their

liquidity. Despite the challenge, the regulatory bodies were able to issue guidelines for the

regulation and supervision of the institutions as well as

Shari’ah

governance standard. The

regulators have embarked on an Islamic finance awareness campaign as a key component of

their financial inclusion strategy. In partnership with the private sector, they have also

initiated a number of capacity development programmes as a way of addressing the manpower

challenge in the sub-sector. In conclusion, while much has been done, there is a need to further

strengthen the legal environment to give a full backing to Islamic finance in Nigeria.

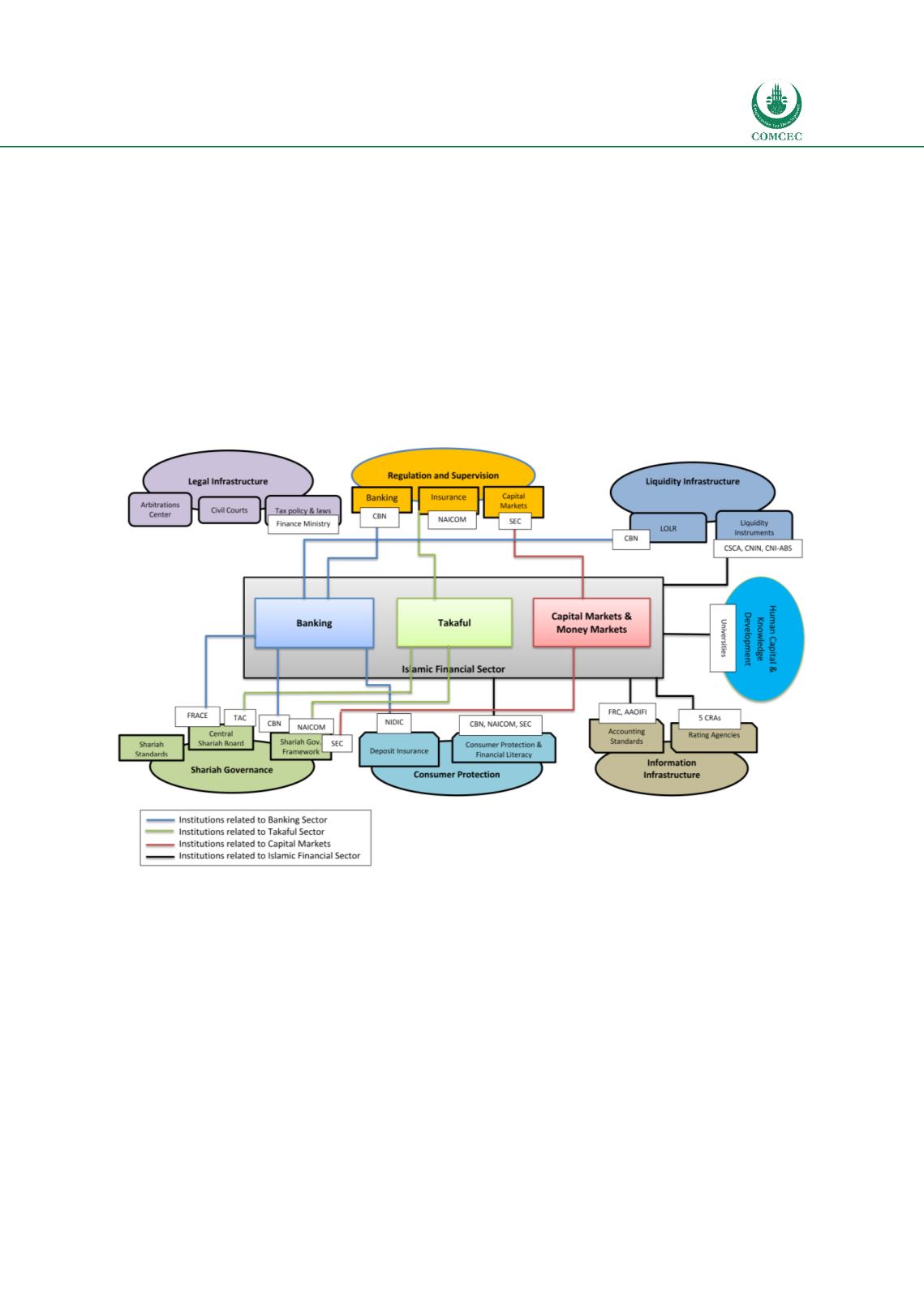

Chart

4.5: Islamic Financial Architecture Institutions—Nigeria