Retail Payment Systems

In the OIC Member Countries

34

•

Guideline V: Retail payments should be supported by appropriate governance and risk

management practices.

•

Guideline VI: Public authorities should exercise effective oversight over the retail

payments market and consider proactive interventions where appropriate (World Bank,

2012).

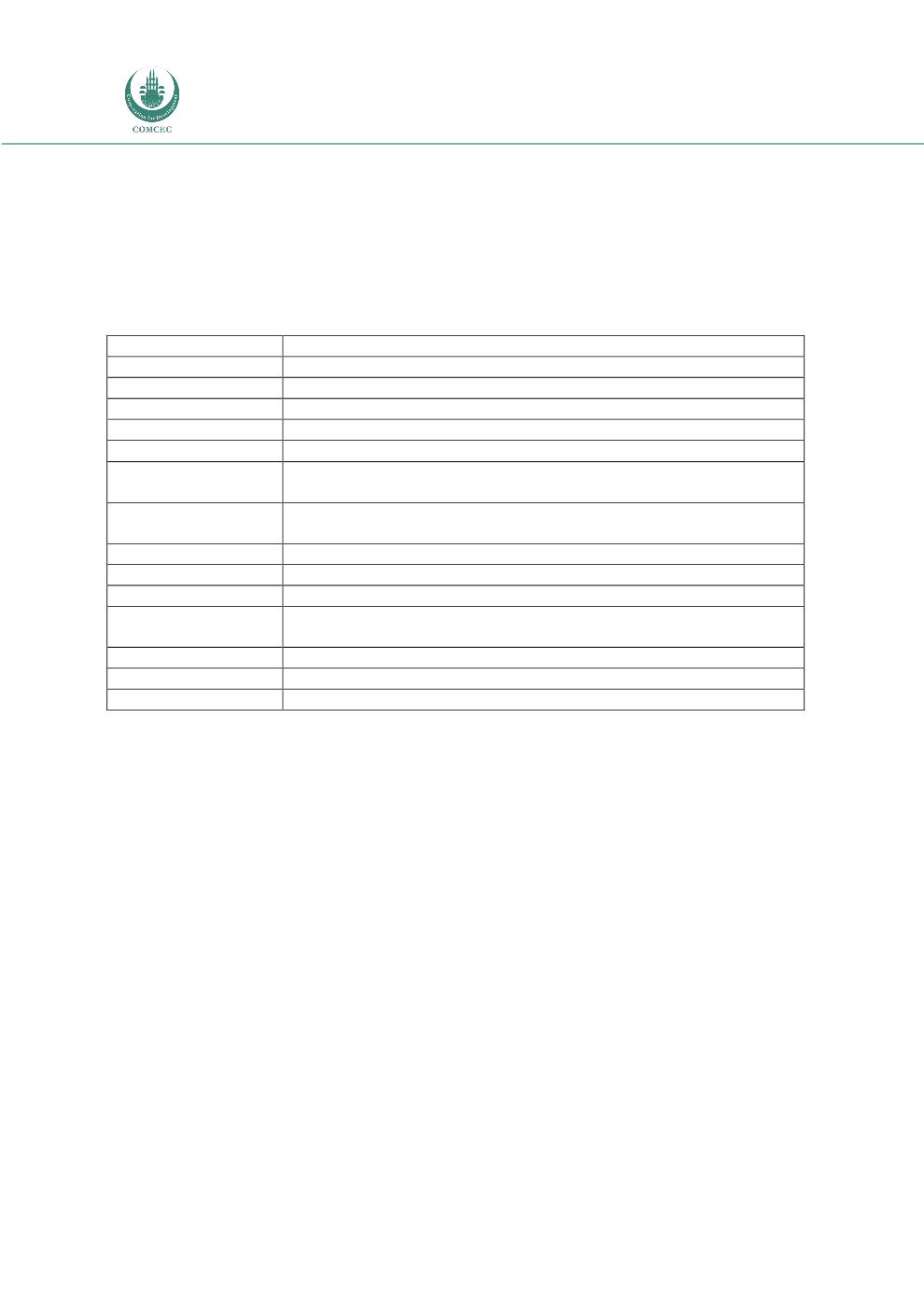

Table 6. OIC Member Countries and their RTGS Systems

Country

RTGS System

Albania

AECH (Albanian Electronic Clearing House System), RTGS

Azerbaijan

AZIPS (Azerbaijan Interbank Payment System)

Egypt

RTGS

Indonesia

Sistem Bank Indonesia Real Time Gross Settlement (BI-RTGS)

Iran

SATNA (

سامانه

آنی ناخالص تسویه

, Real-Time Gross Settlement System)

Ivory Coast

STAR-UEMOA (Système de Transfert Autmatisé et de Règlement de

l’UEMOA)

Kuwait

KASSIP (Kuwait's Automated Settlement System for Inter-

Participant Payments)

Malaysia

RENTAS (Real Time Electronic Transfer of Funds and Securities)

Morocco

SRBM (Système de règlement brut du Maroc)

Nigeria

CIFTS (CBN Inter-Bank Funds Transfer System)

Pakistan

Pakistan Real Time Inter-Bank Settlement Mechanism - PRISM (State

Bank of Pakistan)

Saudi Arabia

SARIE (Saudi Arabian Riyal Interbank Express)

Turkey

EFT (Electronic Fund Transfer)

United Arab Emirates UAEFTS (UAE Funds Transfer System)

RTGS systems provide online, real-time information facilities whereby banks can obtain data

on the status of transfers, accounting balances and other basic parameters (BIS, 1997). An

important element that helps to define the operational environment of queuing is the

information available to banks or the system centre with regard to queues. In a RTGS system,

an institution can execute a payment only if it has adequate balances in its settlement account

at the central bank. Thus, any liquidity problem is detected as soon as it arises. Indeed, a RTGS

system does not eliminate the possibility that an institution may fail and unable to make

payments as they fall due, but it does limit the problem to the failed institution.