Facilitating Trade:

Improving Customs Risk Management Systems

In the OIC Member States

66

Border Management Plan. The strategic risks identified are terrorism, biosecurity threats,

import of prohibited and restricted good, unauthorized movement of people and revenue

collection (customs duty, taxes, etc.)

The implementation of the defined strategic risks is applied through the Cargo Intervention

Strategy (CIS) and Differentiated Risk Response Model (DRRM)

62

.

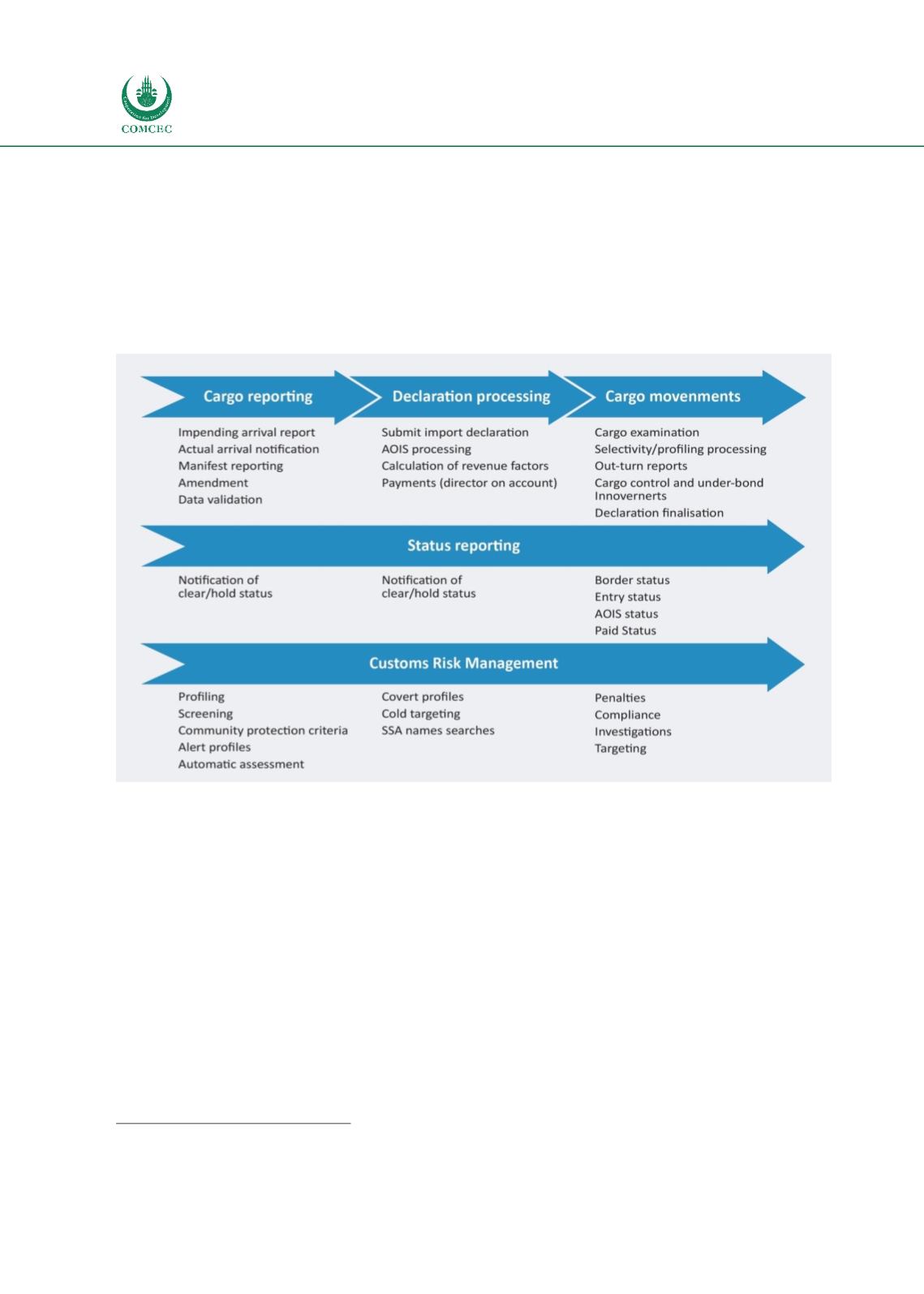

The risk profiles and alerts at tactical level are used for inspection and examination of

consignments. The Australian Customs Import Process is presented i

n Figure 20.Figure 20: Australian Customs Import Process

Author’s compilation

These compliance strategies look at importer's education, the seizure/detention of goods as well

as administrative penalties. Customs and Border Protection have enhanced its risk management

arrangements over time and, more recently, has developed a multi-year CRM planning

framework to align decisions on resource allocation with the assessment of organizational and

border-related risks.

The CRM makes use of pre-arrival and pre-departure information that Australian Customs

require in specific timeframes for reporting on cargo that will need to be imported into Australia.

For all air cargo the information must be reported two hours before arrival, and for all sea cargo,

the information must be reported 48 hours before arrival. The Australian Border Force will not

clear any cargo if it lacks pre-arrival information, and additionally, traders, agents, and involved

individuals can face substantial fines. All of the above finds support in the Australian Customs

Act and Customs Regulations.

62

https://www.anao.gov.au/work/performance-audit/administration-tariff-concession-system