Facilitating Trade:

Improving Customs Risk Management Systems

In the OIC Member States

63

Source: New Zealand Customs Service

3.2.2.10

New Zealand Secure Exports Scheme (SES) - AEO

Based on Customs and Excise Act from 1996, Section 53C, in 2004, New Zealand introduces the

Secure Exports Scheme (SES), a concept similar to AEO. As part of SES, the exporters are

responsible for third-party sites and logistics including transport operators and brokers. As of

December 2016, 124 exporters are part of the SES scheme. The SES exporters are operating from

production site to the port of loading. The SES scheme member has the following benefits

60

:

Reduced export transaction fees for lodgment of all export entries;

Lower potential for intervention by NZ Customs which allows more time to load

shipments and complete export documentation, lowering compliance costs;

Provides access to border clearances with countries that have mutual recognition

arrangement (MRA) with NZ Customs;

NZ Customs can provide advice and assistance for unexpected issues in respect of export

goods with overseas border agencies that have an MRA with NZ Customs.

New Zealand signed Mutual Recognition Arrangements (MRAs) with customs services in other

countries with similar supply chain security standards; USA Jun 2007, Japan May 2008, South

Korea Jun 2011 and Australia July 2016. New Zealand being negotiated theMRAs with Singapore

and China.

3.2.3

Australian Customs Risk Management System

3.2.3.1

Evolution of the Risk Management Implementation

After 48 months of design and development, Australian Customs in 1972 implements the first

automated import system in the world –Integrated System for Processing Entries for Customs

(or INSPECT). Before, all customs entries were processed manually.

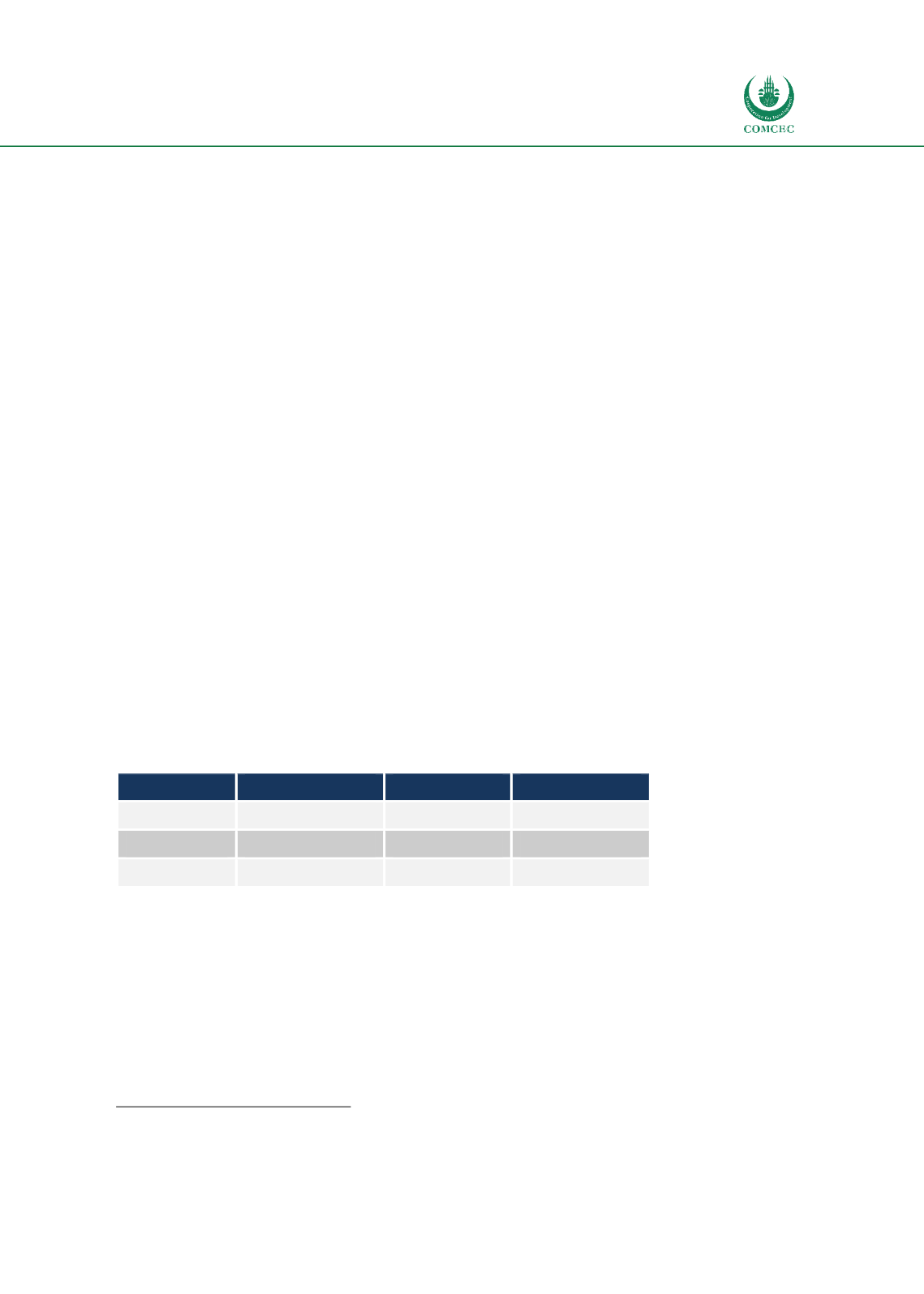

The volume of import and export entries in the last three years, presented in Table 13:

Table 13: Australia Customs volume of import and export entries

2014-2015

2015-2016

2016-2017

Export entries

3,800,000

3,800,000

3,900,000

Import entries

1,430,000

1,510,000

1,350.00

Total entries

5,230,000

5,310,000

5,250,000

Source: Australian Customs

3.2.3.2

Australian Trusted Trader (ATT) – AEO

Australian Trusted Trader is an Authorized Economic Operator (AEO) programme. Australian

Trusted Trader is a voluntary trade facilitation initiative, recognizes businesses with a secure

supply chain and compliant trade practices. Based on the Customs Act 1901/June 2017, the ACS

enables accreditation as a Trusted Trader and provides the relevant benefits. As of January 2017,

there is an 11 accredited Trusted Traders.

Current benefits for accredited Trusted Traders include

61

:

60

https://www.customs.govt.nz/globalassets/documents/fact-sheets/fact-sheet-34-secure-exports-scheme.pdf61

https://www.homeaffairs.gov.au/busi/cargo-support-trade-and-goods/australian-trusted-trader/benefits